Question: 3. Construct a long straddle with K=56 a) What is the maximum loss to the buyer of long straddle? b) What are the two breakeven

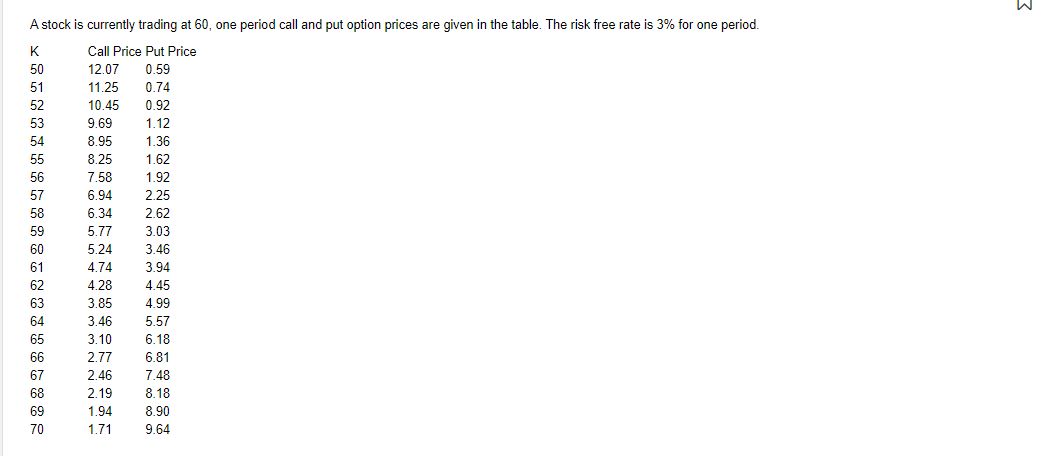

3. Construct a long straddle with K=56 a) What is the maximum loss to the buyer of long straddle? b) What are the two breakeven prices? and c) What is the profit of the long straddle if the stock price at expiry is 67 ? d) What is the maximum gain to the short straddle e) What is the profit of the short straddle if the stock price at expiry is 62 ? A stock is currently trading at 60 , one period call and put option prices are given in the table. The risk free rate is 3% for one period. \begin{tabular}{lll} K & \multicolumn{2}{l}{ Call Price Put P } \\ 50 & 12.07 & 0.59 \\ 51 & 11.25 & 0.74 \\ 52 & 10.45 & 0.92 \\ 53 & 9.69 & 1.12 \\ 54 & 8.95 & 1.36 \\ 55 & 8.25 & 1.62 \\ 56 & 7.58 & 1.92 \\ 57 & 6.94 & 2.25 \\ 58 & 6.34 & 2.62 \\ 59 & 5.77 & 3.03 \\ 60 & 5.24 & 3.46 \\ 61 & 4.74 & 3.94 \\ 62 & 4.28 & 4.45 \\ 63 & 3.85 & 4.99 \\ 64 & 3.46 & 5.57 \\ 65 & 3.10 & 6.18 \\ 66 & 2.77 & 6.81 \\ 67 & 2.46 & 7.48 \\ 68 & 2.19 & 8.18 \\ 69 & 1.94 & 8.90 \\ 70 & 1.71 & 9.64 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts