Question: 3. Cost Volume Profit Analysis or Break Even Analysis You are given the financial information below Tom's Treasures Income Statement For Year Ended 12/31/14 Sales

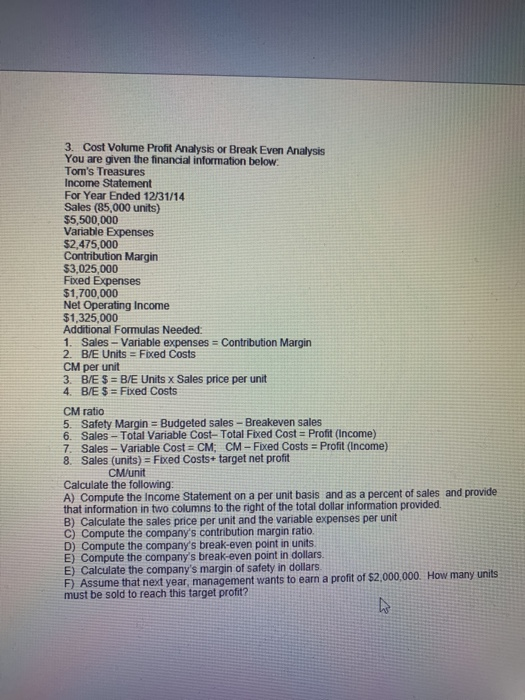

3. Cost Volume Profit Analysis or Break Even Analysis You are given the financial information below Tom's Treasures Income Statement For Year Ended 12/31/14 Sales (85,000 units) $5,500,000 Variable Expenses $2,475,000 Contribution Margin $3,025,000 Fixed Expenses $1,700,000 Net Operating Income $1,325,000 Additional Formulas Needed Sales-Variable expenses Contribution Margin 2. B/E Units Fxed Costs CM per unit 3. B/E S B/E Units x Sales price per unit 4, B/E $ Fixed Costs CM ratio 5. Safety Margin Budgeted sales-Breakeven sales 6. Sales-Total Variable Cost-Total Fixed Cost = Profit (income) 7. Sales-Variable CostCM: CM-Fixed Costs-Profit (income) 8. Sales (units)- Fixed Costs+ target net profit CM/unit Calculate the following: A) Compute the Income Statement on a per unit basis and as a percent of sales and provide that information in two columns to the right of the total dollar information provided B) Calculate the sales price per unit and the variable expenses per unit C) Compute the company's contribution margin ratio. D) Compute the company's break-even point in units E) Compute the company's break-even point in dollars E) Calculate the company's margin of safety in dollars F) Assume that next year, management wants to earn a profit of $2,000,000. How many units must be sold to reach this target profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts