Question: 3 ) Create a plot of the dividend growth over the sample period. Discuss factors for the company that is affecting the dividend growth rate.

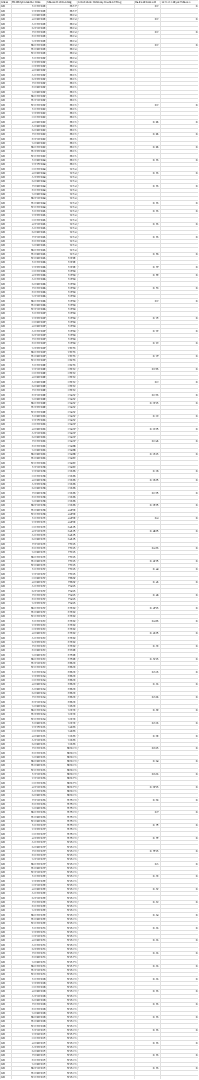

Create a plot of the dividend growth over the sample period. Discuss factors for the company that is affecting the dividend growth rate. Research the firm and industry to identify these economic factors, do not simply give your opinion. You will calculate the required rate of return for the stock using a market model regression. You must discuss this method in the report and comment on the statistical quality of your estimated discount rate. You must create a formal table of the stock price you estimate. The table should include the value based on the estimated discount rate and the goal seek discount rate. Analyze the difference between the calculated discount rate and the fitted discount rate. You must also calculate the stock price based on the constant growth dividend discount model and discuss the financial implications of the methods. Estimate the dividend discount model based on and years rather than the years used in the base model. Create a formal table showing the four estimates' mean, median, and standard deviation. Discuss the financial implications of this analysis. In addition, find the average contribution to the stock's price for only the dividend in year Include this value in your discussion. Use the calculated discount rate for this table. Create a formal table estimating the dividend discount model based on and years using goal seek to fit the discount rate. The table should contain the fitted discount rate, the mean stock price and the standard deviation. Discuss the financial and economic implications of this table. An economic and financial discussion of the cause of the results should accompany any required table or plot. Do not simply describe a plot as going up and down or state the values in the included table. Average $ Std $ Median $ Max $ Min $ High Range $ Low Range $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock