Question: 3. Daily Enterprises is purchasing a $9.6 million machine. It will cost $51,000 to transport and install the machine. The machine has a depreciable life

3. Daily Enterprises is purchasing a $9.6 million machine. It will cost $51,000 to transport and install the machine. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.1 million per year along with incremental costs of $1.4 million per year. Daily's marginal tax rate is 21%. You are forecasting incremental free cash flows for Daily Enterprises. What are the incremental free cash flows associated with the new machine?

The free cash flow for year 0 will be $ .(Round to the nearest dollar.)

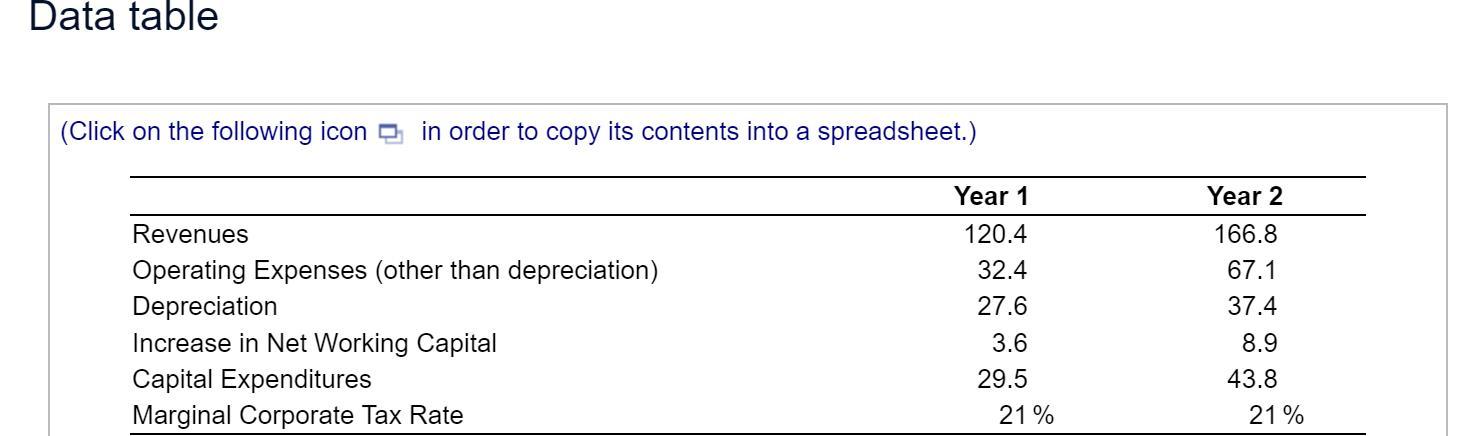

4. Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult toestimate, management has projected the following cash flows for the first two years (in millions of dollars):

a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.)

b. What are the free cash flows for this project for years 1 and 2?

a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.)

Calculate the incremental earnings of this projectbelow:(Round to one decimal place.)

| Incremental Earnings Forecast (millions) | Year 1 | Year 2 | ||

| Sales | $ | $ | ||

| Operating Expenses | $ | $ | ||

| Depreciation | $ | $ | ||

| EBIT | $ | $ | ||

| Income tax at 21% | $ | $ | ||

| Unlevered Net Income | $ | $ |

Part 2

b. What are the free cash flows for this project for years 1 and 2?

Calculate the free cash flows of this project below:(Round to one decimal place.)

| Free Cash Flow (millions) | Year 1 | Year 2 | ||

| Unlevered Net Income | $ | $ | ||

| Depreciation | $ | $ | ||

| Capital Expenditure | $ | $ | ||

| Change in NWC | $ | $ | ||

| Free Cash Flow | $ | $ |

Show transcribed image text

Expert Answer

The free cash flow for years 15 will be $. (Round to the nearest dollar.)

Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 1 Year 2 Revenues Operating Expenses (other than depreciation) Depreciation Increase in Net Working Capital Capital Expenditures Marginal Corporate Tax Rate 120.4 32.4 27.6 3.6 29.5 21 % 166.8 67.1 37.4 8.9 43.8 21 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts