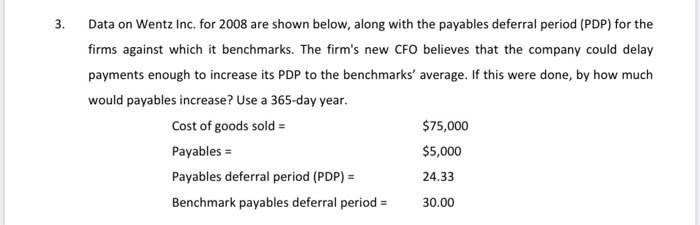

Question: 3. Data on Wentz Inc. for 2008 are shown below, along with the payables deferral period (PDP) for the firms against which it benchmarks. The

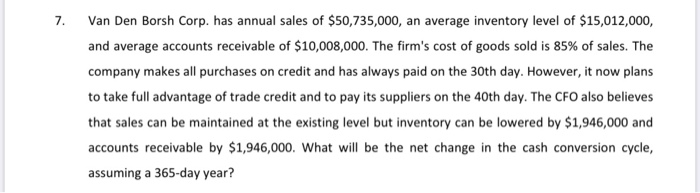

3. Data on Wentz Inc. for 2008 are shown below, along with the payables deferral period (PDP) for the firms against which it benchmarks. The firm's new CFO believes that the company could delay payments enough to increase its PDP to the benchmarks' average. If this were done, by how much would payables increase? Use a 365-day year. Cost of goods sold = $75,000 Payables = $5,000 Payables deferral period (PDP) = 24.33 Benchmark payables deferral period = 30.00 7. Van Den Borsh Corp. has annual sales of $50,735,000, an average inventory level of $15,012,000, and average accounts receivable of $10,008,000. The firm's cost of goods sold is 85% of sales. The company makes all purchases on credit and has always paid on the 30th day. However, it now plans to take full advantage of trade credit and to pay its suppliers on the 40th day. The CFO also believes that sales can be maintained at the existing level but inventory can be lowered by $1,946,000 and accounts receivable by $1,946,000. What will be the net change in the cash conversion cycle, assuming a 365-day year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts