Question: 3. Derek Decoy a Professional Engineer (P Eng) is a course facilitator for the British Columbia DEOh Dantas in Rennram IDED Q1. Brandon Flowers is

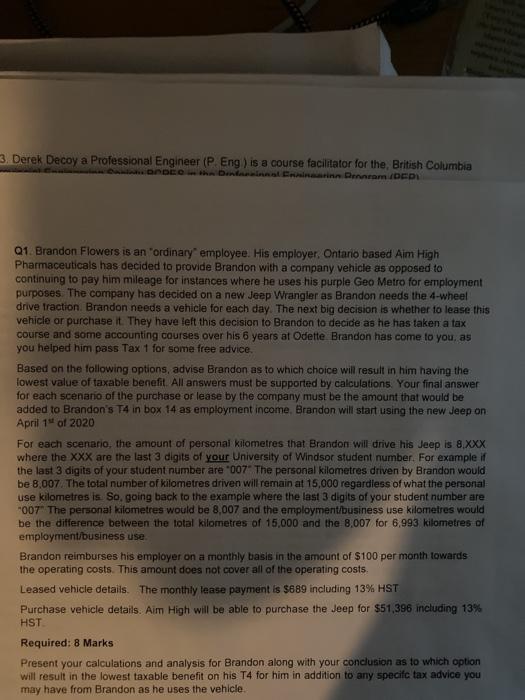

3. Derek Decoy a Professional Engineer (P Eng) is a course facilitator for the British Columbia DEOh Dantas in Rennram IDED Q1. Brandon Flowers is an "ordinary employee. His employer, Ontario based Aim High Pharmaceuticals has decided to provide Brandon with a company vehicle as opposed to continuing to pay him mileage for instances where he uses his purple Geo Metro for employment purposes. The company has decided on a new Jeep Wrangler as Brandon needs the 4-wheel drive traction Brandon needs a vehicle for each day. The next big decision is whether to lease this vehicle or purchase it. They have left this decision to Brandon to decide as he has taken a tax course and some accounting courses over his 6 years at Odette Brandon has come to you, as you helped him pass Tax 1 for some free advice. Based on the following options, advise Brandon as to which choice will result in him having the lowest value of taxable benefit. All answers must be supported by calculations. Your final answer for each scenario of the purchase or lease by the company must be the amount that would be added to Brandon's T4 in box 14 as employment income, Brandon will start using the new Jeep on April 1" of 2020 For each scenario, the amount of personal kilometres that Brandon will drive his Jeep is 8.XXX where the XXX are the last 3 digits of your University of Windsor student number. For example if the last 3 digits of your student number are "007" The personal kilometres driven by Brandon would be 8.007 The total number of kilometres driven will remain at 15,000 regardless of what the personal use kilometres is. So, going back to the example where the last 3 digits of your student number are "007" The personal kilometres would be 8,007 and the employment/business use kilometres would be the difference between the total kilometres of 15,000 and the 8,007 for 6.993 kilometres of employment/business use Brandon reimburses his employer on a monthly basis in the amount of $100 per month towards the operating costs. This amount does not cover all of the operating costs Leased vehicle details. The monthly lease payment is $689 including 13% HST Purchase vehicle details. Aim High will be able to purchase the Jeep for $51,396 including 13% HST Required: 8 Marks Present your calculations and analysis for Brandon along with your conclusion as to which option will result in the lowest taxable benefit on his T4 for him in addition to any specifc tax advice you may have from Brandon as he uses the vehicle 3. Derek Decoy a Professional Engineer (P Eng) is a course facilitator for the British Columbia DEOh Dantas in Rennram IDED Q1. Brandon Flowers is an "ordinary employee. His employer, Ontario based Aim High Pharmaceuticals has decided to provide Brandon with a company vehicle as opposed to continuing to pay him mileage for instances where he uses his purple Geo Metro for employment purposes. The company has decided on a new Jeep Wrangler as Brandon needs the 4-wheel drive traction Brandon needs a vehicle for each day. The next big decision is whether to lease this vehicle or purchase it. They have left this decision to Brandon to decide as he has taken a tax course and some accounting courses over his 6 years at Odette Brandon has come to you, as you helped him pass Tax 1 for some free advice. Based on the following options, advise Brandon as to which choice will result in him having the lowest value of taxable benefit. All answers must be supported by calculations. Your final answer for each scenario of the purchase or lease by the company must be the amount that would be added to Brandon's T4 in box 14 as employment income, Brandon will start using the new Jeep on April 1" of 2020 For each scenario, the amount of personal kilometres that Brandon will drive his Jeep is 8.XXX where the XXX are the last 3 digits of your University of Windsor student number. For example if the last 3 digits of your student number are "007" The personal kilometres driven by Brandon would be 8.007 The total number of kilometres driven will remain at 15,000 regardless of what the personal use kilometres is. So, going back to the example where the last 3 digits of your student number are "007" The personal kilometres would be 8,007 and the employment/business use kilometres would be the difference between the total kilometres of 15,000 and the 8,007 for 6.993 kilometres of employment/business use Brandon reimburses his employer on a monthly basis in the amount of $100 per month towards the operating costs. This amount does not cover all of the operating costs Leased vehicle details. The monthly lease payment is $689 including 13% HST Purchase vehicle details. Aim High will be able to purchase the Jeep for $51,396 including 13% HST Required: 8 Marks Present your calculations and analysis for Brandon along with your conclusion as to which option will result in the lowest taxable benefit on his T4 for him in addition to any specifc tax advice you may have from Brandon as he uses the vehicle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts