Question: (3) Description options for Journal entry: current asset, liabilities, goodwill, investment in Miller. Constructing the Consolidated Balance Sheet at Acquisition On January 1 of the

(3) Description options for Journal entry: current asset, liabilities, goodwill, investment in Miller.

(3) Description options for Journal entry: current asset, liabilities, goodwill, investment in Miller.

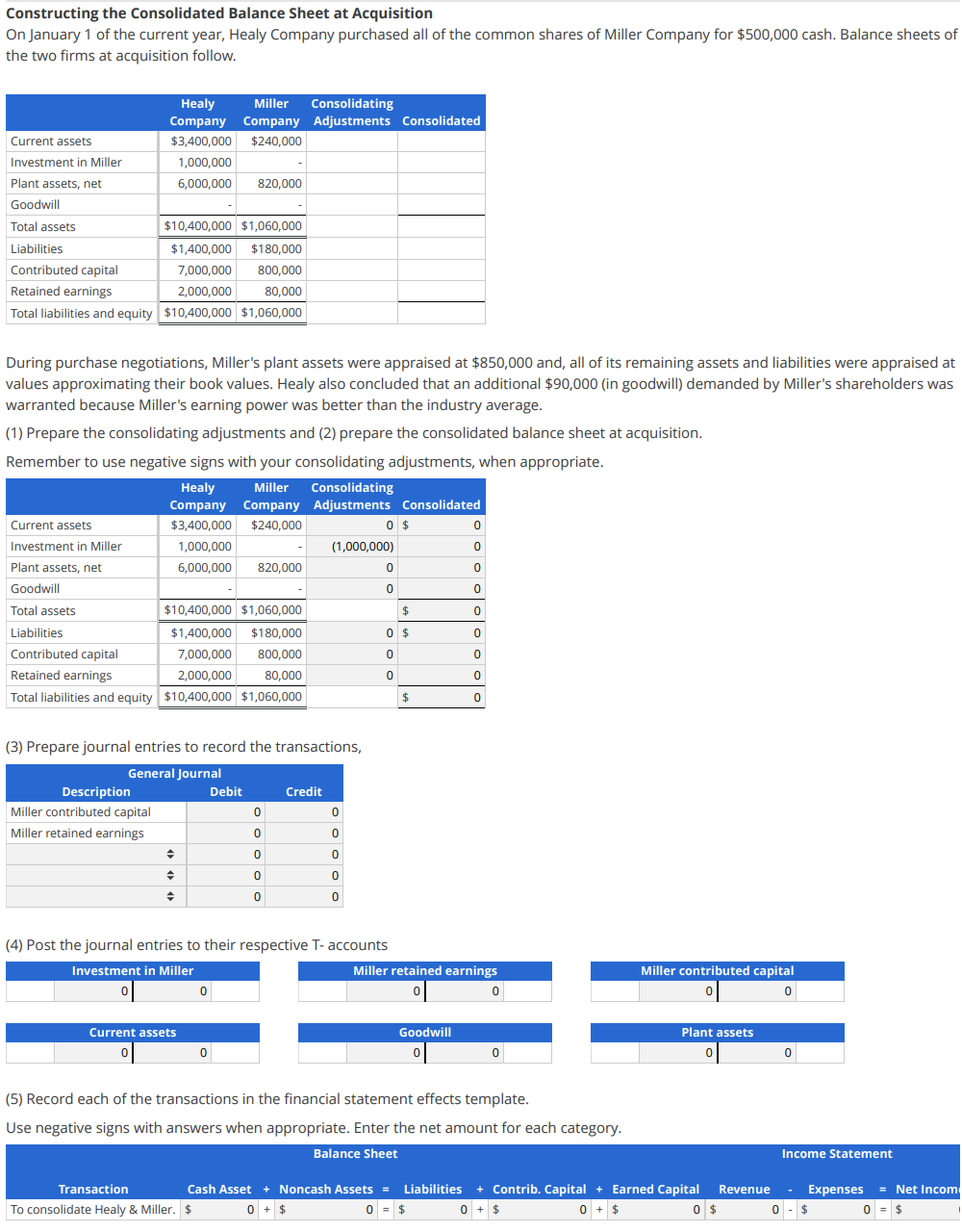

Constructing the Consolidated Balance Sheet at Acquisition On January 1 of the current year, Healy Company purchased all of the common shares of Miller Company for $500,000 cash. Balance sheets of the two firms at acquisition follow. Healy Miller Consolidating Company Company Adjustments Consolidated Current assets $3,400,000 $240,000 Investment in Miller 1,000,000 Plant assets, net 6,000,000 820,000 Goodwill Total assets $10,400,000 $1,060,000 Liabilities $1,400,000 $180,000 Contributed capital 7,000,000 800,000 Retained earnings 2,000,000 80,000 Total liabilities and equity $10,400,000 $1,060,000 During purchase negotiations, Miller's plant assets were appraised at $850,000 and, all of its remaining assets and liabilities were appraised at values approximating their book values. Healy also concluded that an additional $90,000 (in goodwill) demanded by Miller's shareholders was warranted because Miller's earning power was better than the industry average. (1) Prepare the consolidating adjustments and (2) prepare the consolidated balance sheet at acquisition. Remember to use negative signs with your consolidating adjustments, when appropriate. Healy Miller Consolidating Company Company Adjustments Consolidated Current assets $3,400,000 $240,000 0 $ Investment in Miller 1,000,000 (1,000,000) Plant assets, net 6,000,000 820,000 0 0 Goodwill Total assets $10,400,000 $1,060,000 $ Liabilities $1,400,000 $180,000 0 $ Contributed capital 7,000,000 800,000 0 Retained earnings 2,000,000 80,000 0 0 Total liabilities and equity $10,400,000 $1,060,000 $ 0 0 0 0 0 0 0 0 (3) Prepare journal entries to record the transactions, Credit General Journal Description Debit Miller contributed capital Miller retained earnings 0 0 0 0 0 0 0 0 0 0 (4) Post the journal entries to their respective T-accounts Investment in Miller Miller retained earnings 0 0 Miller contributed capital 0 Current assets Goodwill Plant assets 0 0 0 (5) Record each of the transactions in the financial statement effects template. Use negative signs with answers when appropriate. Enter the net amount for each category. Balance Sheet Income Statement Transaction Cash Asset + Noncash Assets = Liabilities + Contrib. Capital + Earned Capital Revenue To consolidate Healy & Miller. $ 0 + $ 0 = $ O + $ 0 + $ 0 $ Expenses = Net Incom = $ Constructing the Consolidated Balance Sheet at Acquisition On January 1 of the current year, Healy Company purchased all of the common shares of Miller Company for $500,000 cash. Balance sheets of the two firms at acquisition follow. Healy Miller Consolidating Company Company Adjustments Consolidated Current assets $3,400,000 $240,000 Investment in Miller 1,000,000 Plant assets, net 6,000,000 820,000 Goodwill Total assets $10,400,000 $1,060,000 Liabilities $1,400,000 $180,000 Contributed capital 7,000,000 800,000 Retained earnings 2,000,000 80,000 Total liabilities and equity $10,400,000 $1,060,000 During purchase negotiations, Miller's plant assets were appraised at $850,000 and, all of its remaining assets and liabilities were appraised at values approximating their book values. Healy also concluded that an additional $90,000 (in goodwill) demanded by Miller's shareholders was warranted because Miller's earning power was better than the industry average. (1) Prepare the consolidating adjustments and (2) prepare the consolidated balance sheet at acquisition. Remember to use negative signs with your consolidating adjustments, when appropriate. Healy Miller Consolidating Company Company Adjustments Consolidated Current assets $3,400,000 $240,000 0 $ Investment in Miller 1,000,000 (1,000,000) Plant assets, net 6,000,000 820,000 0 0 Goodwill Total assets $10,400,000 $1,060,000 $ Liabilities $1,400,000 $180,000 0 $ Contributed capital 7,000,000 800,000 0 Retained earnings 2,000,000 80,000 0 0 Total liabilities and equity $10,400,000 $1,060,000 $ 0 0 0 0 0 0 0 0 (3) Prepare journal entries to record the transactions, Credit General Journal Description Debit Miller contributed capital Miller retained earnings 0 0 0 0 0 0 0 0 0 0 (4) Post the journal entries to their respective T-accounts Investment in Miller Miller retained earnings 0 0 Miller contributed capital 0 Current assets Goodwill Plant assets 0 0 0 (5) Record each of the transactions in the financial statement effects template. Use negative signs with answers when appropriate. Enter the net amount for each category. Balance Sheet Income Statement Transaction Cash Asset + Noncash Assets = Liabilities + Contrib. Capital + Earned Capital Revenue To consolidate Healy & Miller. $ 0 + $ 0 = $ O + $ 0 + $ 0 $ Expenses = Net Incom = $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts