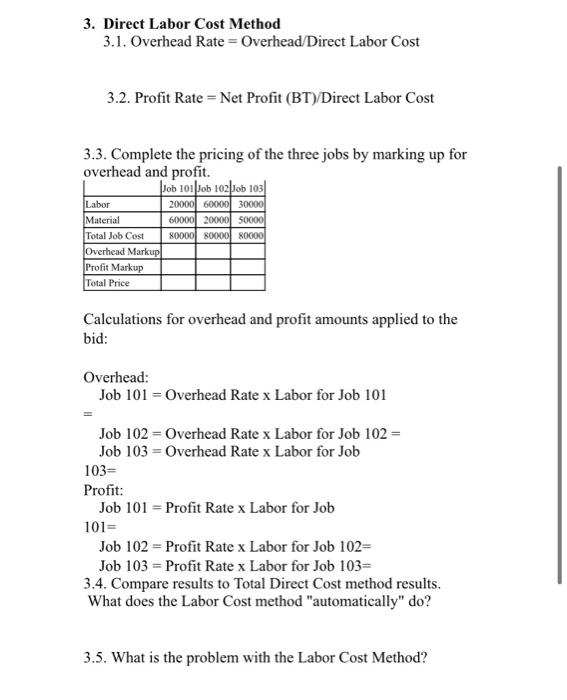

Question: 3. Direct Labor Cost Method 3.1. Overhead Rate = Overhead / Direct Labor Cost 3.2. Profit Rate = Net Profit (BT)/ Direct Labor Cost 3.3.

3. Direct Labor Cost Method 3.1. Overhead Rate = Overhead / Direct Labor Cost 3.2. Profit Rate = Net Profit (BT)/ Direct Labor Cost 3.3. Complete the pricing of the three jobs by marking up for overhead and profit. Calculations for overhead and profit amounts applied to the bid: Overhead: Job 101 = Overhead Rate x Labor for Job 101 Job 102= Overhead Rate x Labor for Job 102= Job 103= Overhead Rate x Labor for Job 103= Profit: Job 101 = Profit Rate x Labor for Job 101= Job 102= Profit Rate x Labor for Job 102= Job 103= Profit Rate x Labor for Job 103= 3.4. Compare results to Total Direct Cost method results. What does the Labor Cost method "automatically" do? 3.5. What is the problem with the Labor Cost Method? 3. Direct Labor Cost Method 3.1. Overhead Rate = Overhead / Direct Labor Cost 3.2. Profit Rate = Net Profit (BT)/ Direct Labor Cost 3.3. Complete the pricing of the three jobs by marking up for overhead and profit. Calculations for overhead and profit amounts applied to the bid: Overhead: Job 101 = Overhead Rate x Labor for Job 101 Job 102= Overhead Rate x Labor for Job 102= Job 103= Overhead Rate x Labor for Job 103= Profit: Job 101 = Profit Rate x Labor for Job 101= Job 102= Profit Rate x Labor for Job 102= Job 103= Profit Rate x Labor for Job 103= 3.4. Compare results to Total Direct Cost method results. What does the Labor Cost method "automatically" do? 3.5. What is the problem with the Labor Cost Method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts