Question: a) Briefly explain the circumstances under which the management of a company, acting in the interest of its existing shareholders, might issue shares in order

a) Briefly explain the circumstances under which the management of a company, acting in the interest of its existing shareholders, might issue shares in order to finance a small project with negative expected net present value. (4 marks)

dont need b's b) Explain some of the adjustments we need to make in order to separate operating, financing and investing activities when reformulating financial statements. (5 marks)

Write down three accounting relations connecting free cash flow, operating income net operating assets, net financial expense, net financial obligations and payments to debt and equity holders. Explain these relations in your own words

Write down three accounting relations connecting free cash flow, operating income net operating assets, net financial expense, net financial obligations and payments to debt and equity holders. Explain these relations in your own words

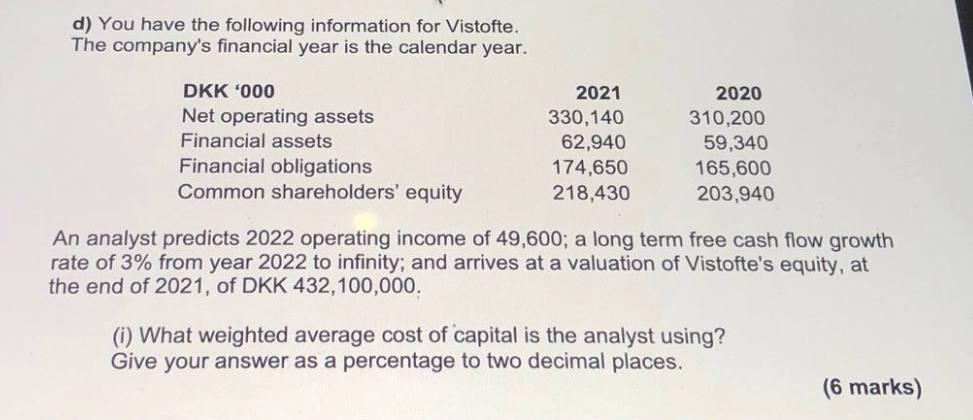

d) You have the following information for Vistofte. The company's financial year is the calendar year. DKK '000 Net operating assets Financial assets Financial obligations Common shareholders' equity 2021 330,140 62,940 174,650 218,430 2020 310,200 59,340 165,600 203,940 An analyst predicts 2022 operating income of 49,600; a long term free cash flow growth rate of 3% from year 2022 to infinity; and arrives at a valuation of Vistofte's equity, at the end of 2021, of DKK 432,100,000. (i) What weighted average cost of capital is the analyst using? Give your answer as a percentage to two decimal places. (6 marks)

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

ANSWER a It is possible that the management of a company may issue shares to finance a small project with a negative expected net present value if the... View full answer

Get step-by-step solutions from verified subject matter experts