Question: 3 . Dr . Taylor has been surprised by the operating loss of her practice over the first 8 months of the fiscal year (

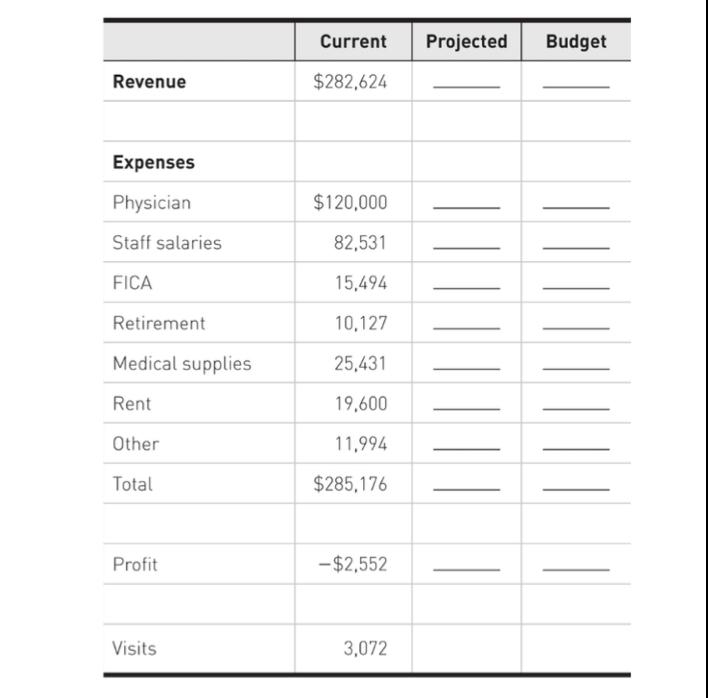

Dr Taylor has been surprised by the operating loss of her practice over the first months of the fiscal year in an independent practice, all losses reduce the income of the owner, ie Dr Taylor Dr Taylor believes improved performance requires better financial planning. The table shows current patient visits, revenues, and expenses. A Annualize current revenues and expenses to calculate the anticipated profit for the current year. B Prepare a budget for the next fiscal year based on Dr Taylor's plan to increase patient visits by ; expected reimbursement of $ per visit; salaries; benefits; medical supplies; and other expenses, which will increase by Given the terms of her lease, rent will increase by What will be next year's profit if budget projections are met? Given the loss expected in Problem Dr Taylor wants to know how the practice will perform if patient visits can be increased to per year, reimbursement remains at $ per visit, increases in salaries and benefits are reduced to and other expenses to medical supplies increase by and rent by If the budget projections are accurate, how much will the practice make or lose next year?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock