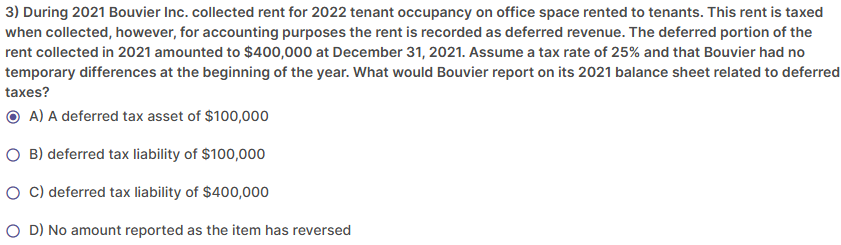

Question: 3 ) During 2 0 2 1 Bouvier Inc. collected rent for 2 0 2 2 tenant occupancy on office space rented to tenants. This

During Bouvier Inc. collected rent for tenant occupancy on office space rented to tenants. This rent is taxed when collected, however, for accounting purposes the rent is recorded as deferred revenue. The deferred portion of the rent collected in amounted to $ at December Assume a tax rate of and that Bouvier had no temporary differences at the beginning of the year. What would Bouvier report on its balance sheet related to deferred taxes?

A A deferred tax asset of $

B deferred tax liability of $

C deferred tax liability of $

D No amount reported as the item has reversed

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock