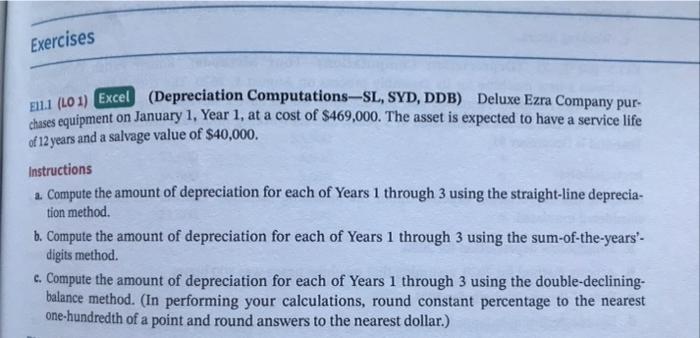

Question: 3. E11.1 page 11-33 a. Straight line depreciation method b. Sum-of-the-years-digit method c. Double-declining-balance method Exercises ELLI (101) Excel (Depreciation Computations --SL, SYD, DDB) Deluxe

Exercises ELLI (101) Excel (Depreciation Computations --SL, SYD, DDB) Deluxe Ezra Company pur chases equipment on January 1, Year 1, at a cost of $469,000. The asset is expected to have a service life of 12 years and a salvage value of $40,000. Instructions a. Compute the amount of depreciation for each of Years 1 through 3 using the straight-line deprecia- tion method. b. Compute the amount of depreciation for each of Years 1 through 3 using the sum-of-the-years- digits method. c. Compute the amount of depreciation for each of Years 1 through 3 using the double-declining- balance method. (In performing your calculations, round constant percentage to the nearest one-hundredth of a point and round answers to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts