Question: 3) Firm A distributed dividends to its shareholders for the current year according to the payout ratio of 35%. Net profit was 40 million TL.

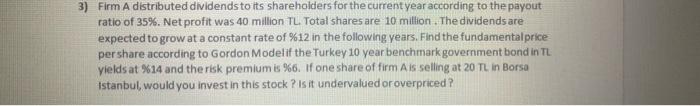

3) Firm A distributed dividends to its shareholders for the current year according to the payout ratio of 35%. Net profit was 40 million TL. Total shares are 10 million. The dividends are expected to grow at a constant rate of %12 in the following years. Find the fundamental price per share according to Gordon Modelif the Turkey 10 year benchmark government bond in TL yields at %14 and the risk premium is %6. If one share of firm Ais selling at 20 TL in Borsa Istanbul, would you invest in this stock? Is it undervalued oroverpriced

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock