Question: 3. First Difference and Fixed Effects Models (Week 12) Suppose you collect annual data from 2014 through 2016 on oil supply in the U.S. You

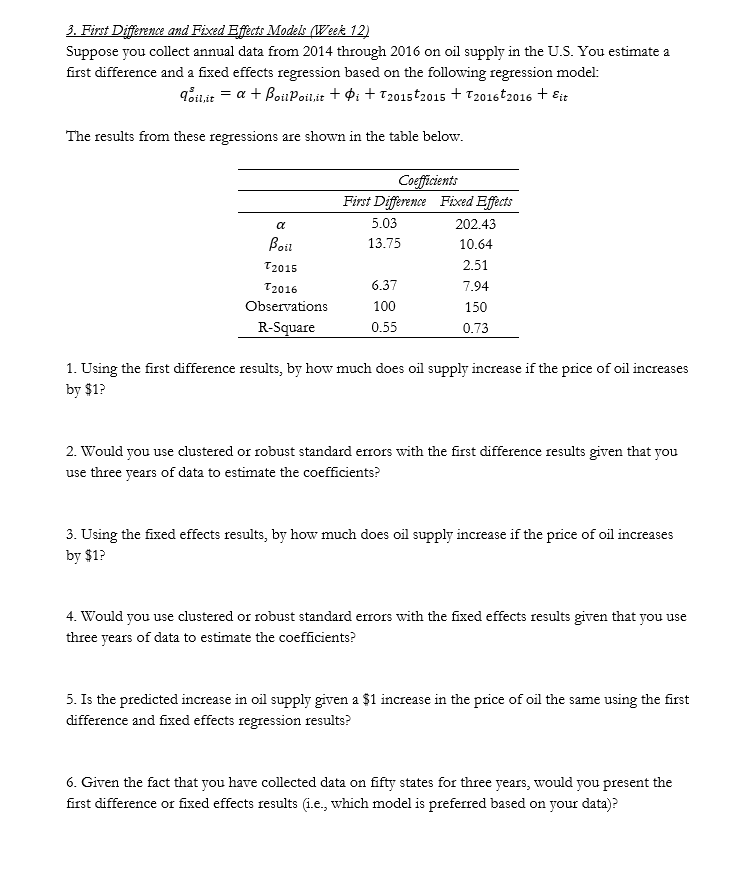

3. First Difference and Fixed Effects Models (Week 12) Suppose you collect annual data from 2014 through 2016 on oil supply in the U.S. You estimate a first difference and a fixed effects regression based on the following regression model: qoil,its=+oilpoil,it+i+2015t2015+2016t2016+it The results from these regressions are shown in the table below. 1. Using the first difference results, by how much does oil supply increase if the price of oil increases by $1 ? 2. Would you use clustered or robust standard errors with the first difference results given that you use three years of data to estimate the coefficients? 3. Using the fixed effects results, by how much does oil supply increase if the price of oil increases by $1 ? 4. Would you use clustered or robust standard errors with the fixed effects results given that you use three years of data to estimate the coefficients? 5. Is the predicted increase in oil supply given a $1 increase in the price of oil the same using the first difference and fixed effects regression results? 6. Given the fact that you have collected data on fifty states for three years, would you present the first difference or fixed effects results (i.e., which model is preferred based on your data)? 3. First Difference and Fixed Effects Models (Week 12) Suppose you collect annual data from 2014 through 2016 on oil supply in the U.S. You estimate a first difference and a fixed effects regression based on the following regression model: qoil,its=+oilpoil,it+i+2015t2015+2016t2016+it The results from these regressions are shown in the table below. 1. Using the first difference results, by how much does oil supply increase if the price of oil increases by $1 ? 2. Would you use clustered or robust standard errors with the first difference results given that you use three years of data to estimate the coefficients? 3. Using the fixed effects results, by how much does oil supply increase if the price of oil increases by $1 ? 4. Would you use clustered or robust standard errors with the fixed effects results given that you use three years of data to estimate the coefficients? 5. Is the predicted increase in oil supply given a $1 increase in the price of oil the same using the first difference and fixed effects regression results? 6. Given the fact that you have collected data on fifty states for three years, would you present the first difference or fixed effects results (i.e., which model is preferred based on your data)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts