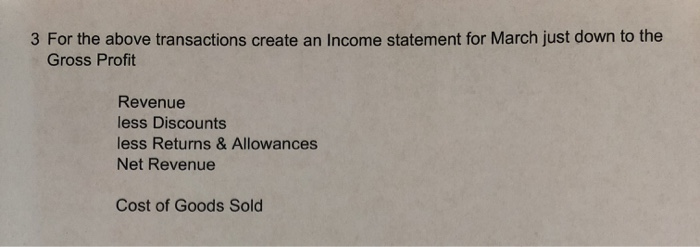

Question: 3 For the above transactions create an Income statement for March just down to the Gross Profit Revenue less Discounts less Returns & Allowances Net

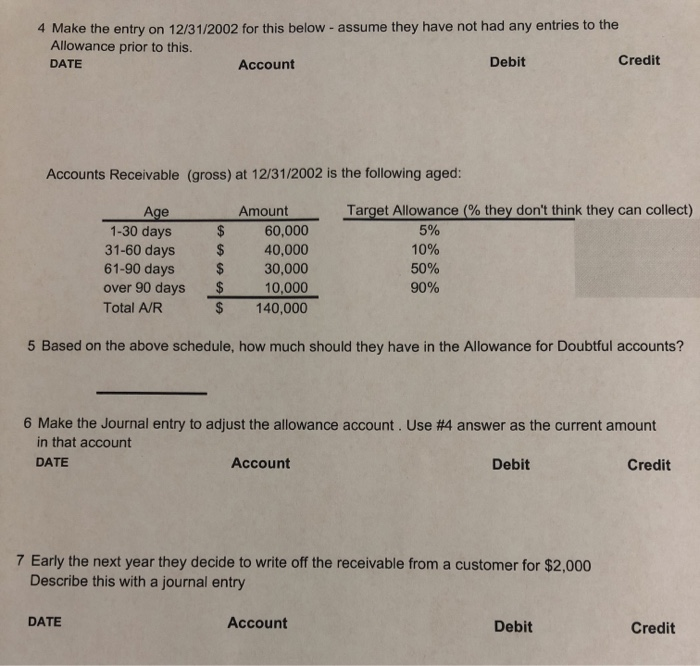

3 For the above transactions create an Income statement for March just down to the Gross Profit Revenue less Discounts less Returns & Allowances Net Revenue Cost of Goods Sold 4 Make the entry on 12/31/2002 for this below - assume they have not had any entries to the Allowance prior to this. DATE Account Debit Credit Accounts Receivable (gross) at 12/31/2002 is the following aged: Target Allowance (% they don't think they can collect) 5% 10% Age 1-30 days 31-60 days 61-90 days over 90 days Total A/R $ $ $ $ $ Amount 60,000 40,000 30,000 10,000 140,000 50% 90% 5 Based on the above schedule, how much should they have in the Allowance for Doubtful accounts? 6 Make the Journal entry to adjust the allowance account. Use #4 answer as the current amount in that account DATE Account Debit Credit 7 Early the next year they decide to write off the receivable from a customer for $2,000 Describe this with a journal entry DATE Account Debit Credit 3 For the above transactions create an Income statement for March just down to the Gross Profit Revenue less Discounts less Returns & Allowances Net Revenue Cost of Goods Sold 4 Make the entry on 12/31/2002 for this below - assume they have not had any entries to the Allowance prior to this. DATE Account Debit Credit Accounts Receivable (gross) at 12/31/2002 is the following aged: Target Allowance (% they don't think they can collect) 5% 10% Age 1-30 days 31-60 days 61-90 days over 90 days Total A/R $ $ $ $ $ Amount 60,000 40,000 30,000 10,000 140,000 50% 90% 5 Based on the above schedule, how much should they have in the Allowance for Doubtful accounts? 6 Make the Journal entry to adjust the allowance account. Use #4 answer as the current amount in that account DATE Account Debit Credit 7 Early the next year they decide to write off the receivable from a customer for $2,000 Describe this with a journal entry DATE Account Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts