Question: ( 3 ) For the next one ( 1 ) month, you are going to execute your chosen opportunity or idea and on the Demo

For the next one month, you are going to execute your chosen opportunity or idea and on the "Demo Day"th June

you are going to present a Pitch Deck before a panel of potential funders investors highlighting the following:

ProblemOpportunity

cdots,

cdots popularity, urgency, growth, frequency, being expensive and being mandatory.

What alternatives are there to solve the problem today? Who has

Who has the

the problem & scale of

scale of the of problem

problem Does this

problem exist only

in certain markets, or

is it a global issue?

global issue?

Solution

Start with a productsolution picture when possible!

Explain via customer journey ie how customeruser experiences the product and advantages.

Avoid a Solution in Search of a Problem SISP

Market Size

How big is your market target audience? Talk in statistics people

money, etc.

How big is the market projected to get?

What is your potential share of this market?

If your numbers aren't in the billions you probably need to think bigger.

The market size is critical as it will also determine the potential returns for the investor down the line.

Competition

Who are the company's competitors?

What are their strengths and weaknesses?

What gives your startup a competitive advantage?

Patents and other defensive IP distribution channels that you have,

partners, etc.

What are the key differentiating features from your competitors?

Revenue ModelBusiness Model

What is your business model?

How will you acquire customers?

How will you make money?

What is the pricing model?

What is the longterm value of a customer?

What are the customer acquisition channels and costs?

Traction

What early traction has the company gotten sales traffic to the company's website, app downloads, growth metrics,

dots the company's w

What strategic partnerships have been consummated?

How can the early traction be accelerated? Press and accolades

Testimonials It's best to foles

It s best to focus on fewer or one main metric to keep it simple

simple and maintain

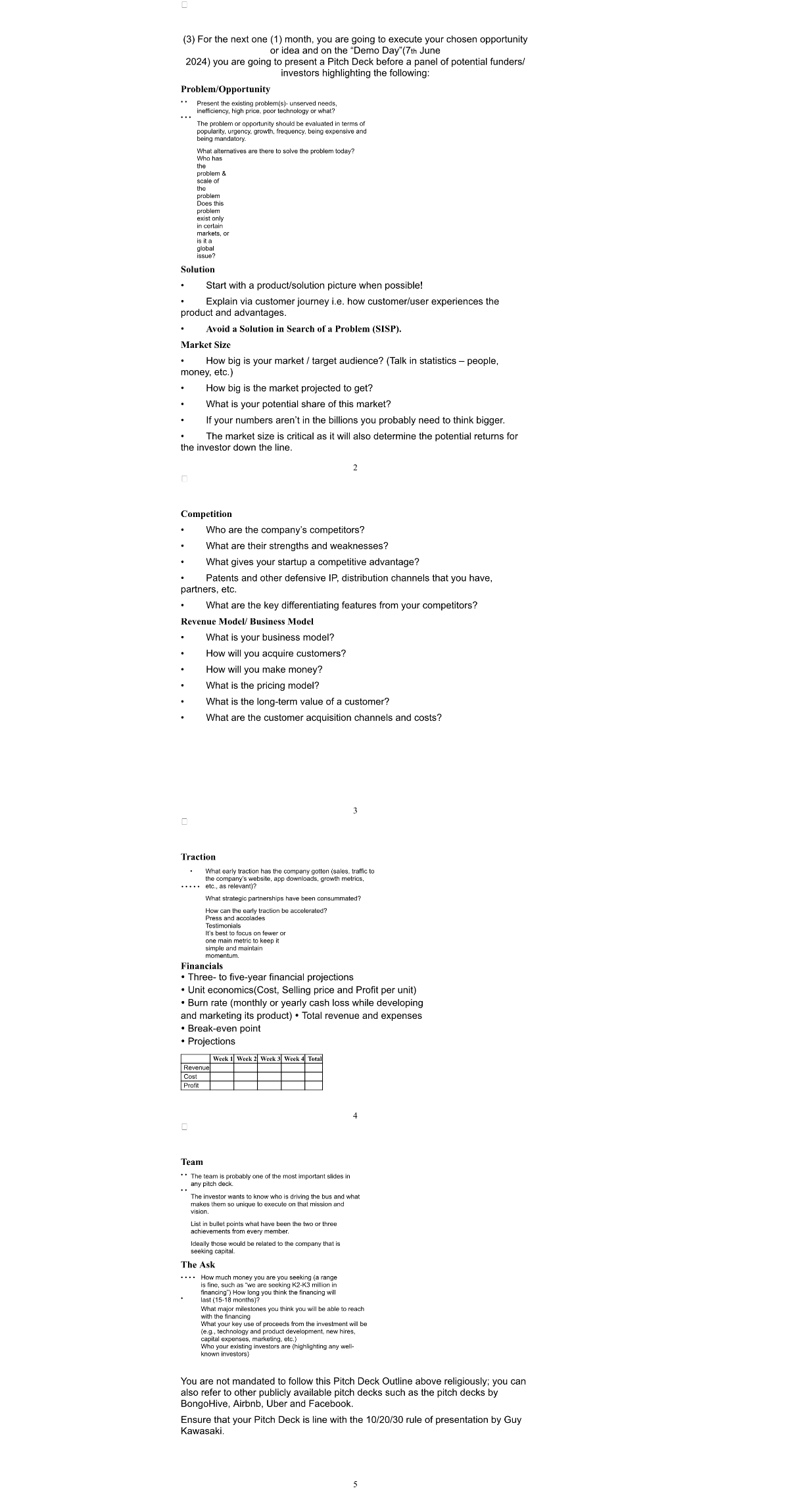

Financials

Three to fiveyear financial projections

Unit economicsCost Selling price and Profit per unit

Burn rate monthly or yearly cash loss while developing

and marketing its product Total revenue and expenses

Breakeven point

Projections

Team

The team is probably one of the most important slides in

any pitch deck.

The investor wants to know who is driving the bus and what makes them so unique to expen that mission and

vision.

List in bullet points what have been the two or three

achievements from every member.

Ideally those would be related to the company that is seeking capital.

The Ask

How much money you are you seeking a range

is fine, such as we are seeking KK million in financing" How long you think the financing will inst months

last months

What major milestones you think you will be able to reach with the financing

What your key use of proceeds from the investment will b eg technology and product development, new hires

capital expenses, marketing, etc. Who your existing investors are highlighting any well

known investors

You are not mandated to follow this Pitch Deck Outline above religiously; you can also refer to other publicly available pitch decks such as the pitch decks by BongoHive, Airbnb, Uber and Facebook.

Ensure that your Pitch Deck is line with the rule of presentation by Guy Kawasaki.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock