Question: 3. Forward Rates and No-arbitrage Pricing - 30 Points Suppose t = 0 and continuously compounded forward rate for the period (1, 2) is given

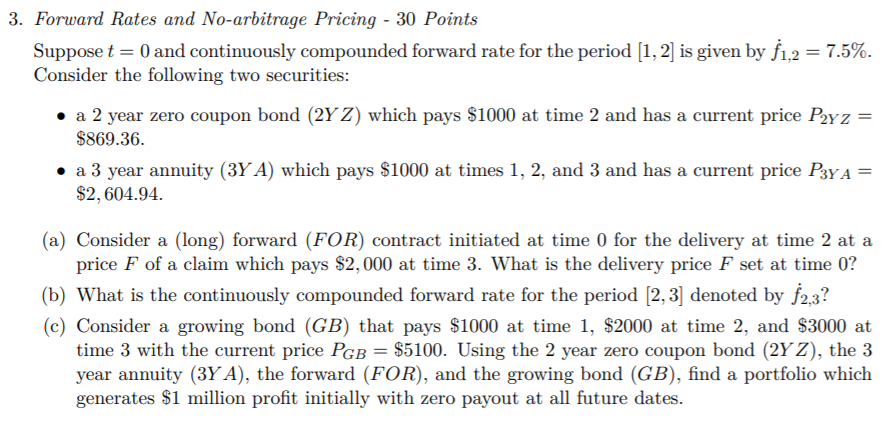

3. Forward Rates and No-arbitrage Pricing - 30 Points Suppose t = 0 and continuously compounded forward rate for the period (1, 2) is given by f1.2 = 7.5%. Consider the following two securities: a 2 year zero coupon bond (2Y Z) which pays $1000 at time 2 and has a current price P2yz = $869.36. a 3 year annuity (3Y A) which pays $1000 at times 1, 2, and 3 and has a current price P3Y A = $2,604.94. (a) Consider a (long) forward (FOR) contract initiated at time 0 for the delivery at time 2 at a price F of a claim which pays $2,000 at time 3. What is the delivery price F set at time 0? (b) What is the continuously compounded forward rate for the period (2, 3) denoted by $2,3? (c) Consider a growing bond (GB) that pays $1000 at time 1, $2000 at time 2, and $3000 at time 3 with the current price PGB = $5100. Using the 2 year zero coupon bond (2Y Z), the 3 year annuity (3Y A), the forward (FOR), and the growing bond ( GB), find a portfolio which generates $1 million profit initially with zero payout at all future dates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts