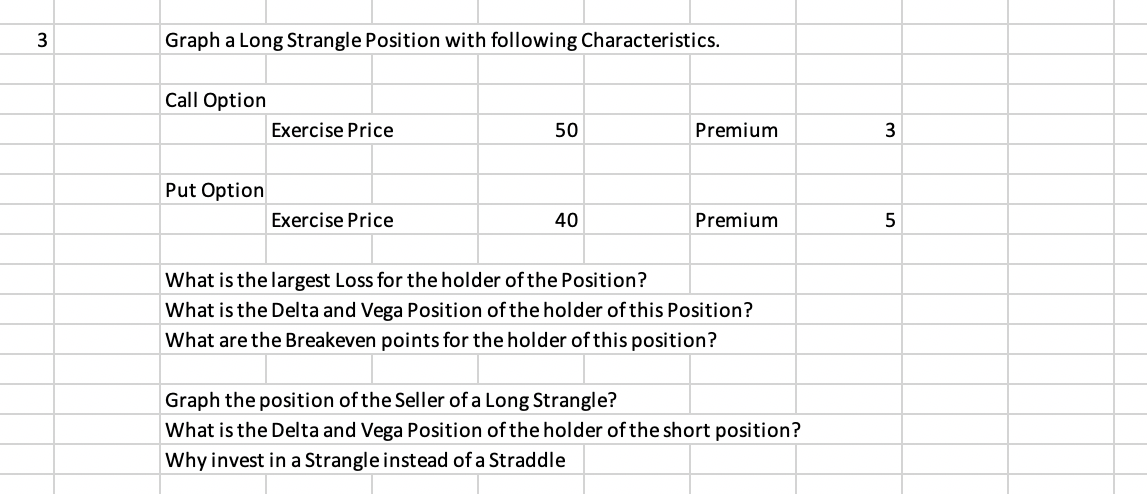

Question: 3 Graph a Long Strangle Position with following Characteristics. Call Option Exercise Price 50 Premium 3 Put Option Exercise Price 40 Premium 5 What is

3 Graph a Long Strangle Position with following Characteristics. Call Option Exercise Price 50 Premium 3 Put Option Exercise Price 40 Premium 5 What is the largest Loss for the holder of the Position? What is the Delta and Vega Position of the holder of this position? What are the Breakeven points for the holder of this position? Graph the position of the Seller of a Long Strangle? What is the Delta and Vega Position of the holder of the short position? Why invest in a Strangle instead of a Straddle 3 Graph a Long Strangle Position with following Characteristics. Call Option Exercise Price 50 Premium 3 Put Option Exercise Price 40 Premium 5 What is the largest Loss for the holder of the Position? What is the Delta and Vega Position of the holder of this position? What are the Breakeven points for the holder of this position? Graph the position of the Seller of a Long Strangle? What is the Delta and Vega Position of the holder of the short position? Why invest in a Strangle instead of a Straddle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts