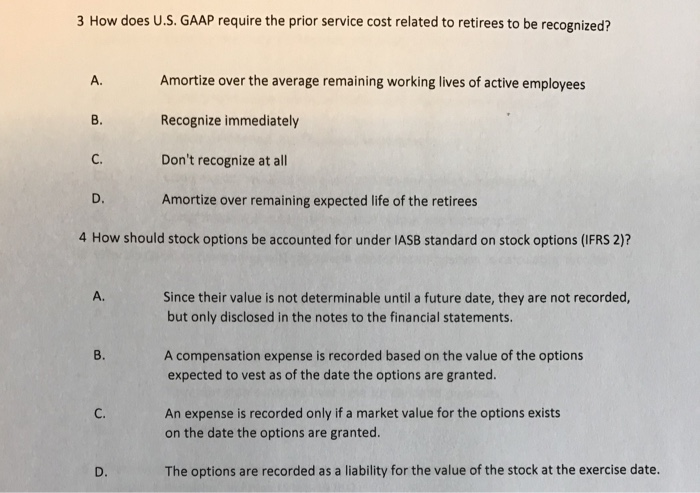

Question: 3 How does U.S. GAAP require the prior service cost related to retirees to be recognized? Amortize over the average remaining working lives of active

3 How does U.S. GAAP require the prior service cost related to retirees to be recognized? Amortize over the average remaining working lives of active employees Recognize immediately Don't recognize at all Amortize over remaining expected life of the retirees 4 How should stock options be accounted for under IASB standard on stock options (IFRS 2)? Since their value is not determinable until a future date, they are not recorded, but only disclosed in the notes to the financial statements. A compensation expense is recorded based on the value of the options expected to vest as of the date the options are granted. An expense is recorded only if a market value for the options exists on the date the options are granted. The options are recorded as a liability for the value of the stock at the exercise date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts