Question: 3! i need the CORRECT answer asap! I will give a thumbs up! Pleaseee! Dixie Chicken is about to close one of its fast food

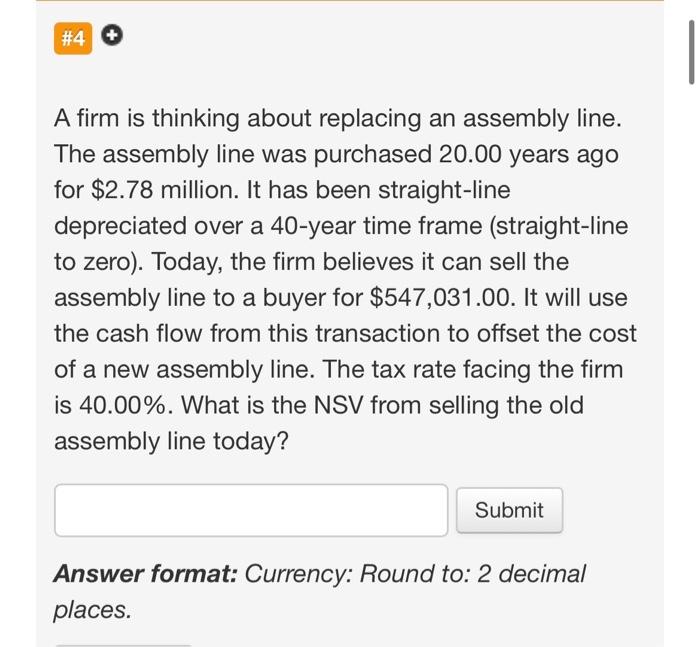

Dixie Chicken is about to close one of its fast food franchises. As part of the closing, the firm will sell a refrigeration unit and its cooking units. The book value of the refrigeration unit is currently $21,438.00, while the book value of the cooking unit is $2,826.00. A buyer has offered $13,443.00 for the refrigerator and $6,205.00 for the cooking unit. The tax rate facing the firm is 38.00%. What is the cash flow from selling these assets? Answer format: Currency: Round to: 2 decimal places. A firm is thinking about replacing an assembly line. The assembly line was purchased 20.00 years ago for $2.78 million. It has been straight-line depreciated over a 40-year time frame (straight-line to zero). Today, the firm believes it can sell the assembly line to a buyer for $547,031.00. It will use the cash flow from this transaction to offset the cost of a new assembly line. The tax rate facing the firm is 40.00%. What is the NSV from selling the old assembly line today? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts