Question: 3. Image that it is the year 2050. Consider the United States and the countries it trades with the most (measured in trade volume): Canada,

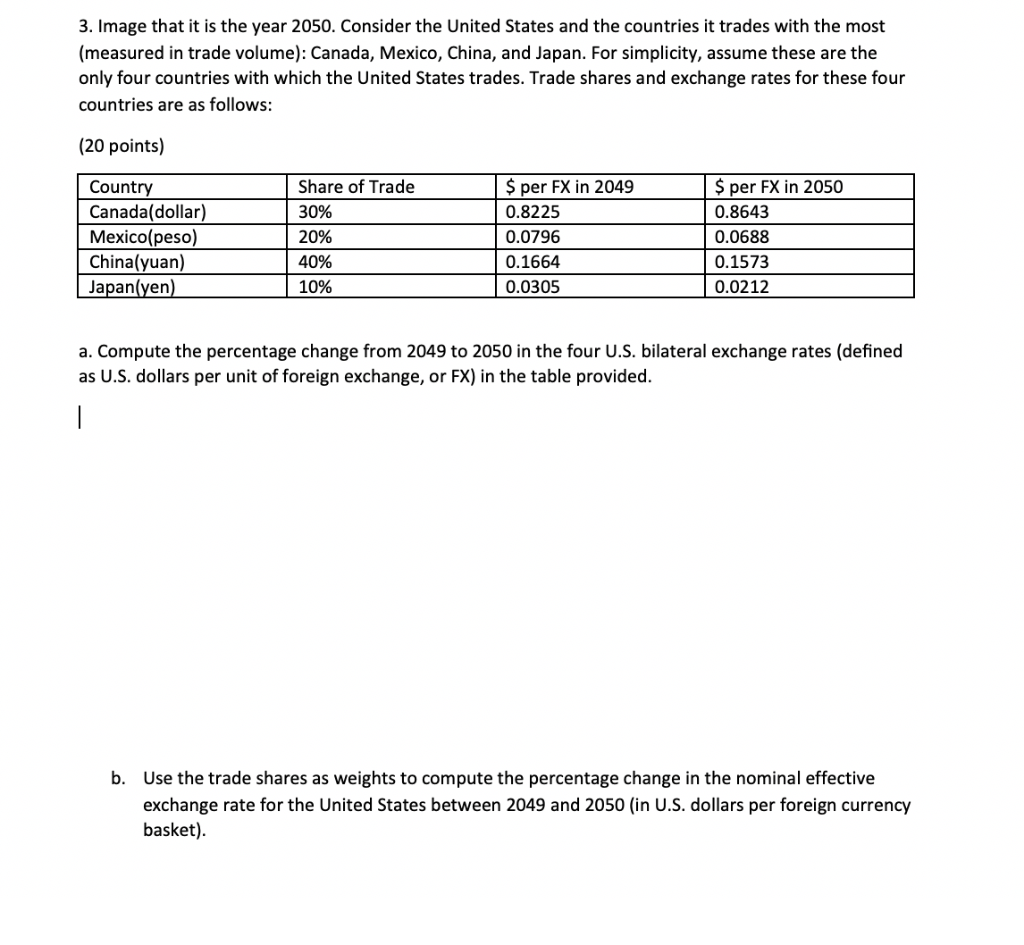

3. Image that it is the year 2050. Consider the United States and the countries it trades with the most (measured in trade volume): Canada, Mexico, China, and Japan. For simplicity, assume these are the only four countries with which the United States trades. Trade shares and exchange rates for these four countries are as follows: (20 points) Country Canada(dollar) Mexico(peso) China(yuan) Japan(yen) Share of Trade 30% 20% 40% 10% $ per FX in 2049 0.8225 0.0796 0.1664 0.0305 $ per FX in 2050 0.8643 0.0688 0.1573 0.0212 a. Compute the percentage change from 2049 to 2050 in the four U.S. bilateral exchange rates (defined as U.S. dollars per unit of foreign exchange, or FX) in the table provided. b. Use the trade shares as weights to compute the percentage change in the nominal effective exchange rate for the United States between 2049 and 2050 (in U.S. dollars per foreign currency basket). 3. Image that it is the year 2050. Consider the United States and the countries it trades with the most (measured in trade volume): Canada, Mexico, China, and Japan. For simplicity, assume these are the only four countries with which the United States trades. Trade shares and exchange rates for these four countries are as follows: (20 points) Country Canada(dollar) Mexico(peso) China(yuan) Japan(yen) Share of Trade 30% 20% 40% 10% $ per FX in 2049 0.8225 0.0796 0.1664 0.0305 $ per FX in 2050 0.8643 0.0688 0.1573 0.0212 a. Compute the percentage change from 2049 to 2050 in the four U.S. bilateral exchange rates (defined as U.S. dollars per unit of foreign exchange, or FX) in the table provided. b. Use the trade shares as weights to compute the percentage change in the nominal effective exchange rate for the United States between 2049 and 2050 (in U.S. dollars per foreign currency basket)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts