Question: 3. Imflation in project analysis It is often easy to overlook the impact of inflation on the net present value of the project. Not incorporiting

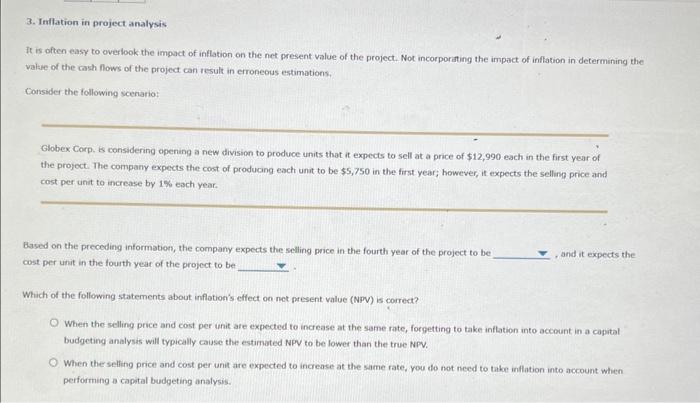

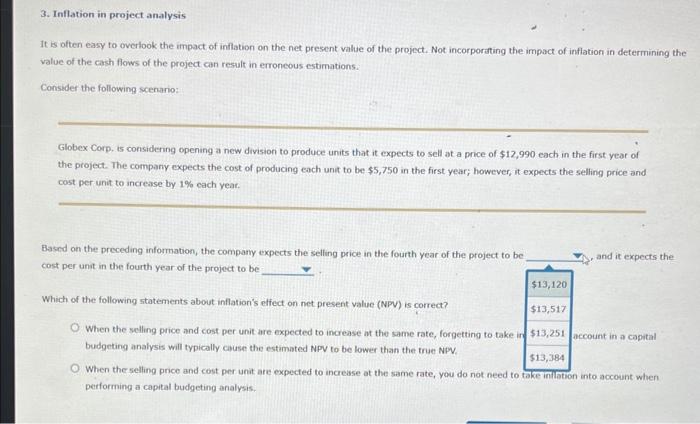

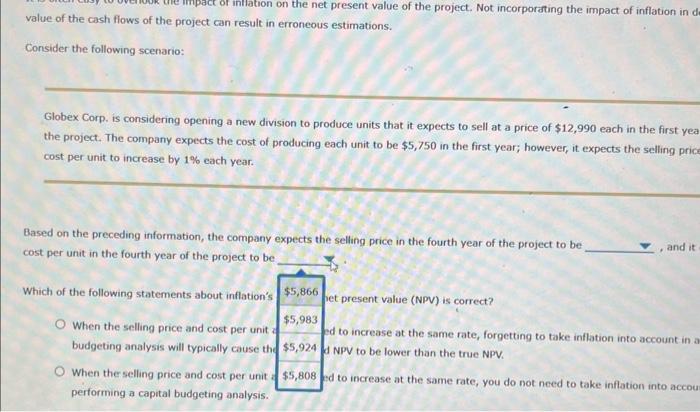

3. Imflation in project analysis It is often easy to overlook the impact of inflation on the net present value of the project. Not incorporiting the irmpact of inftation in determining the value of the cash flows of the project can result in erroneous estimations. Consider the following scenario: Globex Corp. is considering opening a new division to produce units that it expects to sell at a price of $12,990 each in the first year of the projoct. The company expects the cost of producang each unit to be $5,750 in the first year; however, if expects the selling price and cost per unit to increase by 1% each year. Based on the preceding information, the company expects the selling price in the fourth year of the project to be cost per unit in the fourth year of the project to bet Which of the followng statements about inflotion's eflect on net present value (NpV) is correct? When the selling price and cost per unit are expected to increase at the same rate, foroetting to take intlation into account in a capital budgeting analysis will typically cause the estimated NFV to be lower than the true NPV. When the selling price and cost per unit are expected to increase at the same rate, you do not need to take inflation into account when performing a capital budgeting analysis. 3. Inflation in project analysis It is often easy to overlook the impact of inflation on the net present value of the project. Not incorporating the impoct of inflation in determining the value of the cash flows of the project can result in erroneous estimations. Consider the following scenario: Globex Corp. is considering opening a new division to produce units that it expects to sell at a price of $12,990 each in the first year of the project. The company expects the cost of producing each unit to be $5,750 in the first year; however, it expects the selling price and cost per unit to increase by 1% cach year. Based on the preceding information, the company expects the selling price in the fourth year of the project to be cost per unit in the fourth year of the project to be Which of the following statements about inflation's effect on net present value (NPV) is correct? When the selling price and cost per unit are expected to increase it the same rate, forgetting to take in $13,251 account in a capital budgeting analysis will typically cause the estimated NPV to be lower than the true NPV. When the selling price and cost per unit are expected to increase at the same rate, you do not need to take intetion into account when performing a capital budgeting analysis. value of the cash flows of the project can result in erroneous estimations. Consider the following scenario: Globex Corp. is considering opening a new division to produce units that it expects to sell at a price of $12,990 each in the first yea the project. The company expects the cost of producing each unit to be $5,750 in the first year; however, it expects the selling pric cost per unit to increase by 1% each year. Based on the preceding information, the company expects the selling price in the fourth year of the project to be cost per unit in the fourth year of the project to be When the selling price and cost per unit 2$5,983 ped to increase at the same rate, forgetting to take inflation into account in budgeting analysis will typically cause the $5,924 d NPV to be lower than the true NPV. When the selling price and cost per unit a $5,808 pd to increase at the same rate, you do not need to take inflation into accou performing a capital budgeting analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts