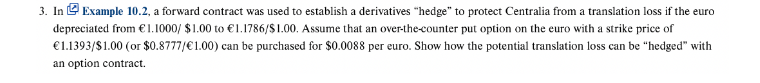

Question: 3. In (2) Example 10.2, a forward contract was used to establish a derivatives hedge to protect Centralia from a translation loss if the euro

3. In (2) Example 10.2, a forward contract was used to establish a derivatives "hedge" to protect Centralia from a translation loss if the euro depreciated from 1.1000/$1.00 to 1.1786/$1.00. Assume that an over-the-counter put option on the euro with a strike price of 1.1393/$1.00 (or $0.8777/1.00 ) can be purchased for $0.0088 per euro. Show how the potential translation loss can be "hedged" with an option contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts