Question: 3. In a year in which inflation is predicted to be 10%, three company executives disagree on what baseline raise would leave employees in the

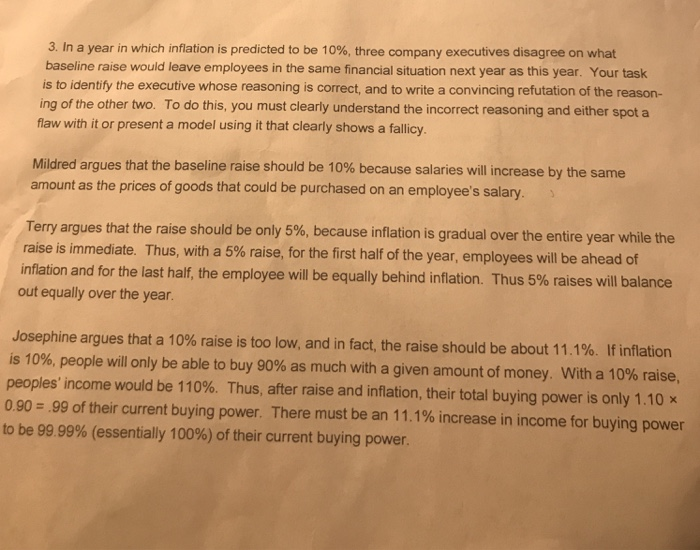

3. In a year in which inflation is predicted to be 10%, three company executives disagree on what baseline raise would leave employees in the same financial situation next year as this year. Your task is to identify the executive whose reasoning is correct, and to write a convincing refutation of the reason- ing of the other two. To do this, you must clearly understand the incorrect reasoning and either spot a flaw with it or present a model using it that clearly shows a fallicy Mildred argues that the baseline raise should be 10% because salaries will increase by the same amount as the prices of goods that could be purchased on an employee's salary. Terry argues that the raise should be only 5%, because inflation is gradual over the entire year while the raise is immediate. Thus, with a 5% raise, for the first half of the year, employees will be ahead of inflation and for the last half, the employee will be equally behind inflation. Thus 5% raises will balance out equally over the year Josephine argues that a 10% raise is too low, and in fact, the raise should be about 11.1%. If inflation is 10%, people will only be able to buy 90% as much with a given amount of money. With a 10% raise, peoples' income would be 110%. Thus, after raise and inflation, their total buying power is only 1.10 0.90-.99 of their current buying power. There must be an 11.1% increase in income for buying power to be 99 99% (essentially 100%) of their current buying power

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts