Question: 3. Incremental costs Initial and terminal cash flow Aa Aa Marston Manufacturing Company is considering a project that requires an investment in new equipment of

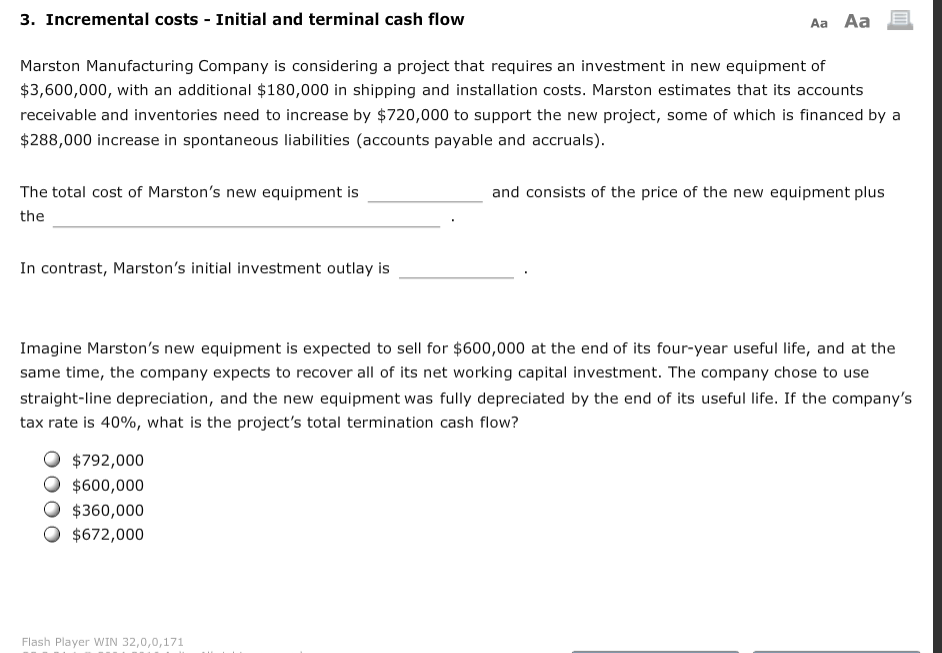

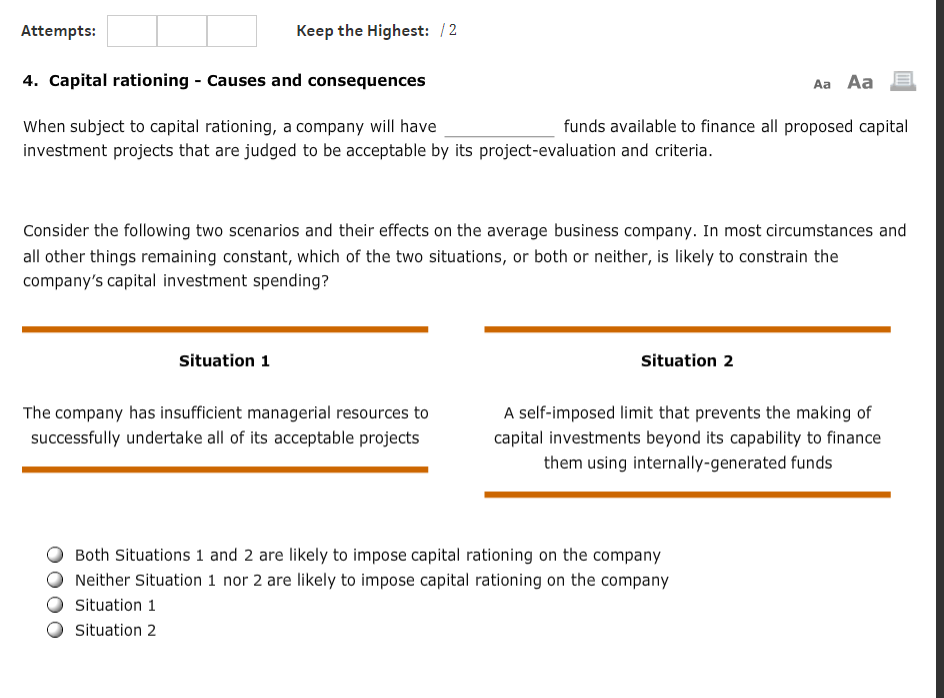

3. Incremental costs Initial and terminal cash flow Aa Aa Marston Manufacturing Company is considering a project that requires an investment in new equipment of $3,600,000, with an additional $180,000 in shipping and installation costs. Marston estimates that its accounts receivable and inventories need to increase by $720,000 to support the new project, some of which is financed by a $288,000 increase in spontaneous liabilities (accounts payable and accruals) The total cost of Marston's new equipment is the and consists of the price of the new equipment plus In contrast, Marston's initial investment outlay is Imagine Marston's new equipment is expected to sell for $600,000 at the end of its four-year useful life, and at the same time, the company expects to recover all of its net working capital investment. The company chose to use straight-line depreciation, and the new equipment was fully depreciated by the end of its useful life. If the company's tax rate is 40%, what is the project's total termination cash flow? O $792,000 $600,000 O$360,000 $672,000 Flash Player WIN 32,0,0,171 Keep the Highest: 12 Attempts: 4. Capital rationing - Causes and consequences Aa Aa When subject to capital rationing, a company will have investment projects that are judged to be acceptable by its project-evaluation and criteria funds available to finance all proposed capital Consider the following two scenarios and their effects on the average business company. In most circumstances and all other things remaining constant, which of the two situations, or both or neither, is likely to constrain the company's capital investment spending? Situation 1 Situation 2 A self-imposed limit that prevents the making of capital investments beyond its capability to finance them using internally-generated funds The company has insufficient managerial resources to successfully undertake all of its acceptable projects Both Situations 1 and 2 are likely to impose capital rationing on the company Neither Situation 1 nor 2 are likely to impose capital rationing on the company Situation 1 situation 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts