Question: 3 Individual Case Write-Up Questions, analyses should be 3 double-spaced pages long, Why does Xiaomi need to enter the international market? Specifically, why does it

3 Individual Case Write-Up Questions, analyses should be 3 double-spaced pages long,

- Why does Xiaomi need to enter the international market? Specifically, why does it need to enter HK, Taiwan, India and S Asia?

- Why is Xiaomi in trouble now?

- If you were Jun Lei which international markets would you choose and which mode of entry would you select for each? Justify your response.

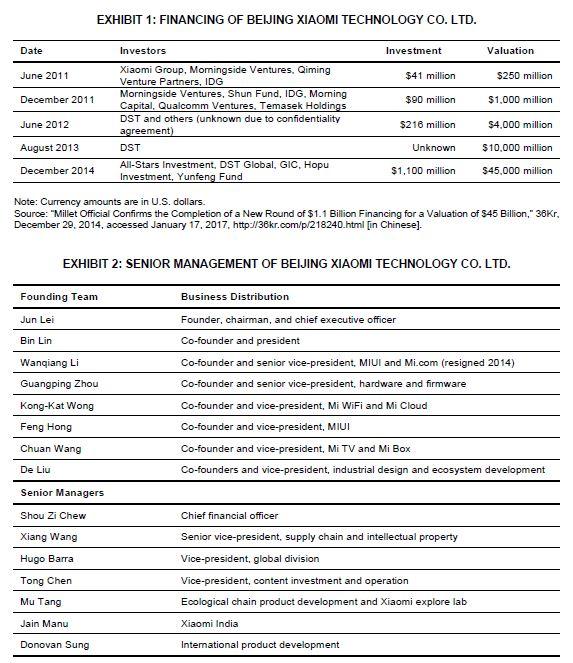

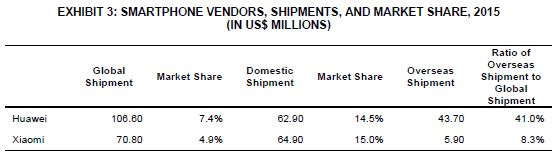

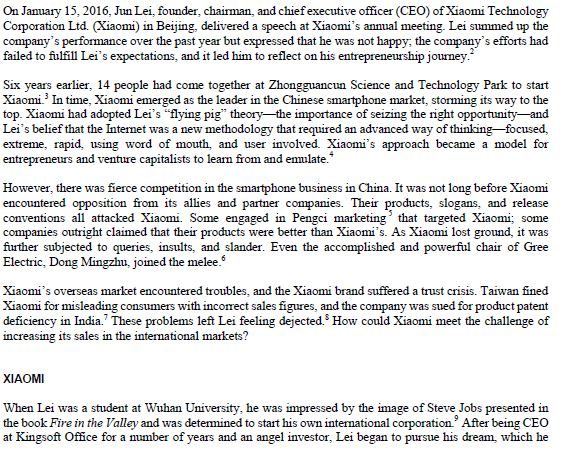

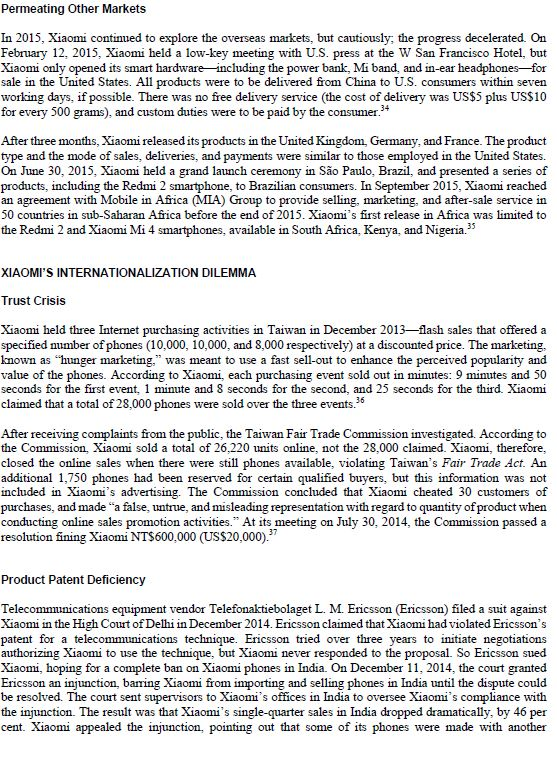

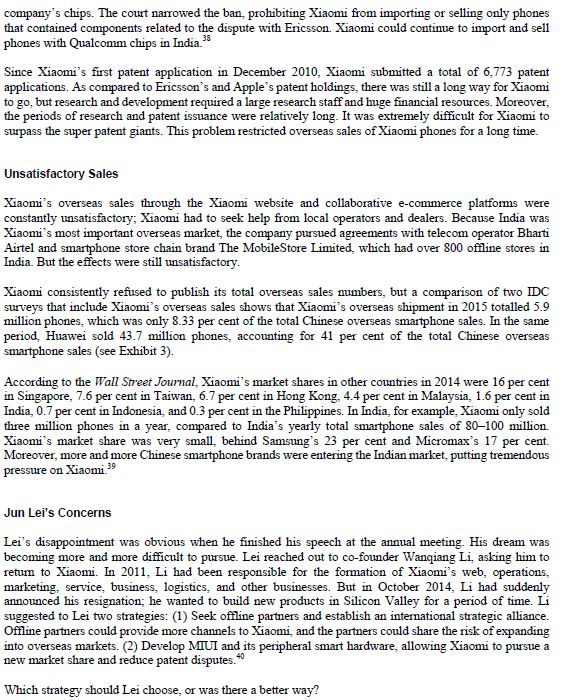

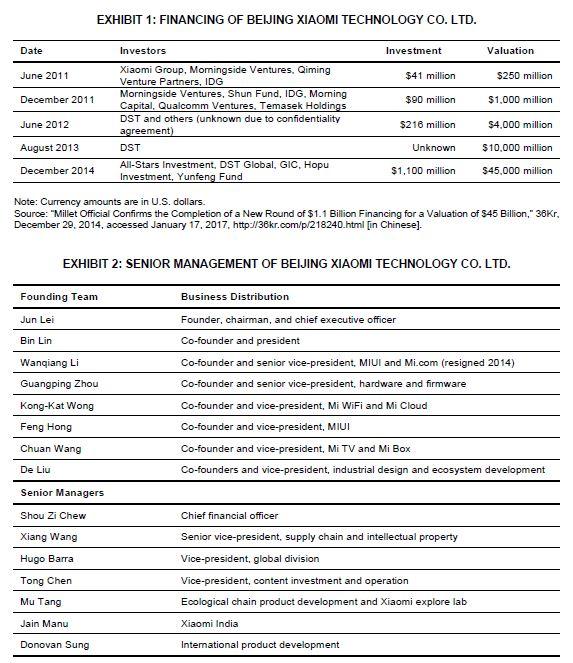

On January 15, 2016, Jun Lei, founder, chairman, and chief executive officer (CEO) of Xiaomi Technology Corporation Ltd. (Xiaomi) in Beijing, delivered a speech at Xiaomi's annual meeting. Lei summed up the company's performance over the past year but expressed that he was not happy, the company's efforts had failed to fulfill Lei's expectations, and it led him to reflect on his entrepreneurship journey. Six years earlier, 14 people had come together at Zhongguancun Science and Technology Park to start Xiaomi. In time, Xiaomi emerged as the leader in the Chinese smartphone market, storming its way to the top. Xiaomi had adopted Lei's flying pig theorythe importance of seizing the night opportunityand Lei's belief that the Internet was a new methodology that required an advanced way of thinkingfocused, extreme, rapid, using word of mouth, and user involved Xiaomi's approach became a model for entrepreneurs and venture capitalists to learn from and emulate." However, there was fierce competition in the smartphone business in China. It was not long before Xiaomi encountered opposition from its allies and partner companies. Their products, slogans, and release conventions all attacked Xiaomi. Some engaged in Pengci marketing that targeted Xiaomi; some companies outright claimed that their products were better than Xiaomi's. As Xiaomi lost ground, it was further subjected to queries, insults, and slander. Even the accomplished and powerful chair of Gree Electric, Dong Mingzhu, joined the melee. Xiaomi's overseas market encountered troubles, and the Xiaomi brand suffered a trust crisis. Taiwan fined Xiaomi for misleading consumers with incorrect sales figures, and the company was sued for product patent deficiency in India. These problems left Lei feeling dejected. How could Xiaomi meet the challenge of increasing its sales in the international markets? XIAOMI When Lei was a student at Wuhan University, he was impressed by the image of Steve Jobs presented in the book Fire in the Valley and was determined to start his own international corporation. After being CEO at Kingsoft Office for a number of years and an angel investor, Lei began to pursue his dream, which he had conceptualized 20 years earlier. He saw a space between the costly international-brand smartphones and the inexpensive made-in-China phones, and he started Xiaomi with some of his like-minded friends to enter that space. The company's namethe Chinese word for "millet," a nutritious and inexpensive Chinese staplereflected the founders' interest in providing useful products that were affordable. Core Hardware Products Xiaomi smartphones (including Xiaomi pads), Xiaomi TV (including Xiaomi set-top box), and Xiaomi router were the first business ventures. Xiaomi then developed a smartphone operating system in collaboration with users of its online forum The phones were also marketed through Xiaomi forum and sold online at M.com, which made Xiaomi phones the first Internet smartphone brand Xiaomi continued to market, sell, and develop through these Internet platforms." Xiaomi smartphones achieved terrific growth increasing from a sales volume of 300.000 handsets in 2011 to sales of 70.8 million in 2015, an increase of over 200 times. This made Xiaomi the fifth-largest smartphone company in the world, after Samsung Group, Apple Inc., Huawei Technologies Co. Ltd., and Lenovo Group Ltd. Due to the popularity of the smartphone, the number of users of Xiaomi's firmware operating system. Mi User Interface (MUI), also increased to an astonishing figure of 170 million, spread over 156 countries around the world. Xiaomi box and Xiaomi TV also served as important ports to attract new users. This was facilitated by high-performance hardware configuration, a smooth operating system, and much original film and TV content. Xiaomi released its routers to create a cross-platform data centre, which enabled users to get data and information from different devices, whenever and wherever they needed. Mi User Interface Xiaomi's Mi User Interface (MUI) and its mobile Internet services were the second part of Xiaomi's "software + hardware + internet business ecosystem. MIUI was a firmware operating system for mobile devices, based on Google's Android operating system." MIUI had two important features: it could be upgraded swiftly, using either a developer's version that was upgraded weekly or a stable version that was upgraded monthly, and the coding was available as software that could be installed on any Android phone, which meant that not only Xiaomi phones but also other Android devices could switch to MUI In addition to providing access to the Internet, MUI offered Internet-based services, such as intelligent call notification, free Wi-Fi. unknown number identification, and an application store." MUI also offered comprehensive Internet-based services such as Xiaomi Lifestyle, which offered retail products and discounts at restaurants, theatres, and other venues; Xiaomi Entertainment, which provided mainly games and films, plus some TV content; and comprehensive financial services for loan financing. All these features had enough potential to generate more income sources for Xiaomi. In 2015, the revenues from Xiaomi Internet services reached CN3.82 billion (US$564 million)," which was a 150 per cent increase compared to the previous year. Smart Hardware Investment Xiaomi planned to invest #33.9 billion (US$5 billion) in 100 smart hardware companies. Lei pinned his hopes on the smartphone, which was the mandatory device that connected all household computerized equipment in the internetworked Internet of Things. Xiaomi gradually built a hardware ecosystem that focused on mobile devices (smartphones and tablets), set-top boxes for televisions, and smart routers. By early 2016, Xiaomi had invested in 55 smart hardware companies, including Huami (wearable technology such as the Mi Band), Qingmi Technology Co. Ltd. (hardware interface devices such as patch boards and cables), Ninebot Inc. (personal transportation devices), Lanmi Technology Bluetooth devices such as headphones), Zimi Corporation (power banks), Zhimi Technology (air purifiers and fans), and Yunmi Technology (water purifiers). By mid-2016, Xiaomi had already made cumulative shipments of 24 million Mi Band units, making Huami the second-largest smart wearable devices company in the world. As a result of the popularity of the Mi Band, Huami raised #237.3 million (US$35 million) in its Series B round of financing: Huami was seeking to start a new round of financing with a valuation of6.8 billion (US$1 billion). Development of Xiaomi Within its first five years, Xiaomi raised five rounds of financing (see Exhibit 1), and its valuation rose from $1.7 billion (US$250 million) to #305 billion (US$45 billion a whopping 179-time increase.20 This meant that Xiaomi had the highest valuation in the world among unlisted technology companies. Yuri Milner, the founder of Digital Sky Technologies Global (DST), who had invested in Facebook, Inc. and Alibaba Group Holding Ltd. (US$100 billion companies), assessed Xiaomi's valuation as having the potential to reach #678 billion (US$100 billion).21 BACKGROUND OF THE SMARTPHONE BUSINESS Development Situation of Smartphone Unlike feature phones, smartphones had an independent operating system. The operating system extended a phone's basic communication functions by allowing installation of new applications (apps). These enhanced functions mainly depended upon the development of mobile Internet. With the development of technology, smartphone functions became more and more powerful, allowing many tasks that were normally carried out on a desktop computer to be accomplished on the phone. The feature phone market was gradually being taken over by smartphones. According to the technology research firm Gartner, Inc., the total global sales of all mobile phones grew from 1.22 billion units in 2008 to 1.917 billion units in 2015. Shipments of smartphones increased from 140 million to 1.39 billion units, while global sales of feature phones decreased from 1.14 billion to 570 million units. The Internationalization of Smartphone Brands Samsung and Apple were the giants in the smartphone business. According to statistics provided by Canaccord Genuity Group Inc., in 2015, Samsung commanded 23.9 per cent of the world's smartphone sales and Apple, 17.2 per cent. However, Apple garnered 91 per cent of the profits of the world's smartphone sales while Samsung took only 14 per cent. Many smartphone manufacturers were incuring losses. Samsung's core ability lay in its smartphone vertical industry chain. The company's key techniques for manufacturing computer chips, random-access memory (RAM) data storage, screens, and other components gave Samsung advantages in product development production, quality, and price." Samsung launched phones of numerous kinds and levels. Phones with different hardware and at different price points were produced around the globe and heavily promoted with celebrities, sportspersons, and non-commercial advertisements. The phones were sold internationally through many channels (through agents and direct to consumers, who could customize their phones). After earning additional profits and establishing its production cycle, Samsung continuously reduced the prices of its old phones to stay in the market and developed new models to replace the old ones. In contrast. Apple used the strategy of single-product explosions, launching only two or three new phones each year. Apple's general headquarters was situated in the United States. It focused on design and development of its products, purchased raw materials and components from more than 500 enterprises in 31 different countries, and completed the assembly process in Foxconn. China. The products were then delivered by air transport to various distribution centres around the world. After new products were released at a convention, Apple's iPhones were sold through individual retail traders, mass retail traders, operators, and Apple stores. The relatively high price of iPhones and their consistent popularity around the world brought tremendous profits for Apple. The Internationalization of Chinese Smartphone Brands The first Chinese smartphone brands that tried to internationalize were Huawei and ZTE Corporation. They established good business relationships with foreign operators by providing telecommunications infrastructure or producing phones for them. Those foreign operators had abundant users, channels, and resources, which provided Chinese brands with many advantages in broadening their markets. Lenovo accelerated its internationalization in smartphones by purchasing Motorola, Inc. for US$2.9 billion. Lenovo acquired 2.000 patent rights owned by Motorola and enjoyed 16,000 patents owned by Google, in addition to acquiring Motorola's mobile brand trademark portfolios, and corporate relationships with more than 50 operators around the world. 25 Coolpad Group Limited (Coolpad) increased its core competitive power by establishing research centres in the United States and India. Coolpad's dual-SIM, dual-standby phone had a leading edge in the smartphone business as a result of its communication-based technology, dual system, phone security, user interface (UI) design, and mobile Internet services." Gionee increased its brand popularity by sponsoring the Kolkata Knight Riders, a celebrity-owned cricket team that played in the Indian Premier League, and establishing and funding a charity that supported under- privileged children diagnosed with leukemia. Arvind Vohra, CEO and managing director of Gionee India, led Gionee in signing contracts with 10 agencies and developing 35,000 Gionee retail stores in India. OnePlus had targeted global markets since its inception. Its invitation system of marketing (similar to that used by Google Glass) delivered OnePlus phones to markets in 17 countries including the United States, Great Britain, France, Germany, Italy, and India.28 XIAOMI'S INTERNATIONALIZATION PRACTICE Internationalization as Both a Dream and a Goal Although China was becoming the world's most influential smartphone market, the Chinese market was becoming saturated. China had been in a period of high-speed development of smartphones since 2010. Smartphone shipments grew by 100 per cent each year for the next three years, but in 2013, the smartphone market began to decline dramatically. At the end of 2015, the number of phone users in China had reached 1.32 billion about 95 per cent of China's population - There was almost no room left for the market to grow. With the need for phone replacements decreasing the development of smartphones entered a passive state. The phone business had already completed its regeneration and upgraded at an accelerated speed; the transformation from functional phone to smartphone was basically completed. In the future, the development of the smartphone business could only rely on upgrades or regeneration of smartphones. As a result of a gradually saturated market, the battle among Chinese smartphone brands was becoming more and more fierce. Many of the vendors who lacked brand popularity, innovative power, core patents, and government allowances were eliminated from the market. Companies like Leshi Internet Information and Technology Corp. (LeEco), Meizu Technology Co. Ltd., Coolpad, and Lenovo, followed Xiaomi by offering similar products at the same price, quality, and functionality. They came out with good phones at attractive prices, which in turn, slowly weakened Xiaomi's competitive power. Xiaomi had captured as much of the market as it could. Xiaomi's total phone shipments in 2015 did not achieve the company's target; only 70.8 million Xiaomi phones were sold in that year. That was an increase of 22.8 per cent from 2014, but the year-on-year growth rate in 2014 was 227 per cent. In addition, Xiaomi's relatively low average price and extremely low profit margin had already put Xiaomi in a critical situation. According to a survey completed by International Data Corporation (IDC), the average selling price of a Xiaomi phone in China was US$141 in 2015, while the average selling price of phones produced by Huawei OPPO Electronics Corp., and Vivo Communication Technology Ltd. was US$213, US$231, and US$208 respectively. Considering that the market situation for Xiaomi was alarming and its profit insufficient to support the corporation itself, Lei intended to enter the international market rapidly to accelerate Xiaomi's development and accomplish his dream of intemationalization. Xiaomi's Internationalization Team In order to enter the overseas markets, Xiaomi initially formed an international management team In addition to Xiaomi's eight founders, Xiaomi welcomed seven team members with senior work experience in well-known international companies such as Google, Tencent, and Qualcomm. The team had four foreigners and six people from China, returning from overseas work (see Exhibit 2). Xiaomi in Hong Kong and Taiwan Because Hong Kong and Taiwan were physically close to Mainland China and their systems, cultures, and commercial traditions were almost identical to that of Mainland China, Bin Lin, Xiaomi's international affairs manager, targeted the "circle of Chinese culture markets as Xiaomi's first overseas attempt. In April 2013, Xiaomi officially initiated its internationalization process. At first, Xiaomi tried to sell its products through e-commerce platforms in Hong Kong and Taiwan. Hong Kong users could buy Xiaomi phones from the Xiaomi website, using PayPal for payment. The phones were delivered from Shenzhen to Hong Kong within three days by S.F. Express Inc. Taiwanese consumers could buy Xiaomi phones from the Xiaomi website, paying with ATM (a process similar to electronic banking), credit card, PayPal, or 7-Eleven Bill Pay. At first, the delivery process to Taiwan was similar to that for Hong Kong. Later, Xiaomi established its own warehouse in Taiwan, and goods were delivered by T-Cat Express Delivery Service from the warehouse to anywhere in Taiwan (with the exception of some remote areas) within 24 hours. In addition to promoting phones on its own website, Xiaomi also collaborated with local operators and e- commerce platforms. Hong Kong Telecommunications Limited was the first dealer to carry Xiaomi phones in Hong Kong. Consumers could purchase Xiaomi phones from Hong Kong Telecom by Internet or telephone order or in an offline store. In Taiwan, Xiaomi first collaborated with FarEasTone Telecommunications. In Taipei, Gaoxiong, and Yilan, advertisements for contract-free Xiaomi phones were on almost every taxi. Xiaomi next established collaborative relationships with Chunghwa Telecom, Taiwan Star Telecom, and the biggest electronic platform in Taiwan, PChome Online Inc. In order to provide better services and communicate with users, Xiaomi opened its MIUI forum and Facebook account for Xiaomi fans in Hong Kong and Taiwan. Moreover, Xiaomi organized many kinds of offline activities to interact with users. To improve users' experience, Xiaomi was planning to build Xiaomi homes" and "Xiaomi smart appliance experience halls" in Hong Kong and Taiwan" Xiaomi in India and Southeast Asia After gaining some experience in Hong Kong and Taiwan, Xiaomi made plans to enter larger markets. After a comprehensive evaluation, three factors emerged for the choice of new markets: the proportion of young people in the population, a fast-growing period of e-commerce, and operators' relatively weak control over phone-selling channels. Lin decided to focus on the Indian and Southeast Asian markets first. 32 In 2014, Xiaomi started to sell its phones and smart hardware in Singapore, Malaysia, Indonesia, Thailand, the Philippines, and India. First, Xiaomi launched its official website in these countries and partnered with local e-commerce platforms. For example, Xiaomi initially signed up exclusively with Flipkart, which was the biggest e-commerce platform in India, and then established strategic relationships with two major e-commerce platforms, Amazon.com Inc. and Snapdeal. Second. Xiaomi established an overseas service team and outsourced after-sales services to local companies. For instance, after-sales service in India was outsourced to Gadget Wood Services Pvt. Ltd. Third, after considering the underdeveloped logistics and payment systems, Xiaomi reached an agreement with electronic commercial platform Lazada Group to sell Xiaomi phones in the Philippines, Indonesia, and Malaysia. Lazada built a giant warehouse for Xiaomi in those countries and established internal transportation teams to deliver Xiaomi phones to the consumers the very next day. The popularity of credit cards in Southeast Asia was comparatively low, so Lazada allowed its consumers to use electronic bank payments, cash on delivery, and other modes of payment. Moreover, Lazada provided customer services in the local language. In India, Xiaomi not only tried to promote its smartphones by using full-page newspaper advertisements, but it also organized large "Xiaomi fan festivals." Xiaomi attracted more people to take advantage of time- limited and quantity-limited discounts on different products. At the Xiaomi 4i release convention in New Delhi, for the first time, Lei greeted his Indian Xiaomi fans by repeating the same words in his imperfect English with a heavy Hubei accent: "Are you OK?" A video clip of the greeting was adapted into many different versions and went viral on the Internet-a perfect viral marketing campaign for Xiaomi." Permeating Other Markets In 2015, Xiaomi continued to explore the overseas markets, but cautiously, the progress decelerated. On February 12, 2015, Xiaomi held a low-key meeting with U.S. press at the W San Francisco Hotel, but Xiaomi only opened its smart hardwareincluding the power bank, Mi band, and in-ear headphones-for sale in the United States. All products were to be delivered from China to U.S. consumers within seven working days, if possible. There was no free delivery service (the cost of delivery was US$5 plus US$10 for every 500 grams), and custom duties were to be paid by the consumer.4 After three months, Xiaomi released its products in the United Kingdom, Germany, and France. The product type and the mode of sales, deliveries, and payments were similar to those employed in the United States. On June 30, 2015, Xiaomi held a grand launch ceremony in So Paulo, Brazil, and presented a series of products, including the Redmi 2 smartphone, to Brazilian consumers. In September 2015, Xiaomi reached an agreement with Mobile in Africa (MA) Group to provide selling, marketing, and after-sale service in 50 countries in sub-Saharan Africa before the end of 2015. Xiaomi's first release in Africa was limited to the Redmi 2 and Xiaomi Mi 4 smartphones, available in South Africa, Kenya, and Nigeria. " XIAOMI'S INTERNATIONALIZATION DILEMMA Trust Crisis Xiaomi held three Internet purchasing activities in Taiwan in December 2013flash sales that offered a specified number of phones (10,000, 10,000, and 8,000 respectively) at a discounted price. The marketing. known as "hunger marketing," was meant to use a fast sell-out to enhance the perceived popularity and value of the phones. According to Xiaomi, each purchasing event sold out in minutes: 9 minutes and 50 seconds for the first event, 1 minute and 8 seconds for the second and 25 seconds for the third. Xiaomi claimed that a total of 28,000 phones were sold over the three events." After receiving complaints from the public, the Taiwan Fair Trade Commission investigated. According to the Commission, Xiaomi sold a total of 26,220 units online, not the 28,000 claimed. Xiaomi, therefore, closed the online sales when there were still phones available, violating Taiwan's Fair Trade Act. An additional 1,750 phones had been reserved for certain qualified buyers, but this information was not included in Xiaomi's advertising. The Commission concluded that Xiaomi cheated 30 customers of purchases, and made a false, untrue and misleading representation with regard to quantity of product when conducting online sales promotion activities." At its meeting on July 30, 2014, the Commission passed a resolution fining Xiaomi NT$600,000 (US$20,000). "? Product Patent Deficiency Telecommunications equipment vendor Telefonaktiebolaget L. M. Ericsson (Ericsson) filed a suit against Xiaomi in the High Court of Delhi in December 2014. Ericsson claimed that Xiaomi had violated Ericsson's patent for a telecommunications technique. Ericsson tried over three years to initiate negotiations authorizing Xiaomi to use the technique, but Xiaomi never responded to the proposal. So Ericsson sued Xiaomi, hoping for a complete ban on Xiaomi phones in India. On December 11, 2014, the court granted Ericsson an injunction, barring Xiaomi from importing and selling phones in India until the dispute could be resolved. The court sent supervisors to Xiaomi's offices in India to oversee Xiaomi's compliance with the injunction. The result was that Xiaomi's single-quarter sales in India dropped dramatically, by 46 per cent. Xiaomi appealed the injunction, pointing out that some of its phones were made with another company's chips. The court narrowed the ban, prohibiting Xiaomi from importing or selling only phones that contained components related to the dispute with Ericsson Xiaomi could continue to import and sell phones with Qualcomm chips in India." Since Xiaomi's first patent application in December 2010, Xiaomi submitted a total of 6.773 patent applications. As compared to Ericsson's and Apple's patent holdings, there was still a long way for Xiaomi to go, but research and development required a large research staff and huge financial resources. Moreover, the periods of research and patent issuance were relatively long. It was extremely difficult for Xiaomi to supass the super patent giants. This problem restricted overseas sales of Xiaomi phones for a long time. Unsatisfactory Sales Xiaomi's overseas sales through the Xiaomi website and collaborative e-commerce platforms were constantly unsatisfactory; Xiaomi had to seek help from local operators and dealers. Because India was Xiaomi's most important overseas market, the company pursued agreements with telecom operator Bharti Airtel and smartphone store chain brand The MobileStore Limited, which had over 800 offline stores in India. But the effects were still unsatisfactory. Xiaomi consistently refused to publish its total overseas sales numbers, but a comparison of two IDC surveys that include Xiaomi's overseas sales shows that Xiaomi's overseas shipment in 2015 totalled 5.9 million phones, which was only 8.33 per cent of the total Chinese overseas smartphone sales. In the same period. Huawei sold 43.7 million phones, accounting for 41 per cent of the total Chinese overseas smartphone sales (see Exhibit 3). According to the Wall Street Journal, Xiaomi's market shares in other countries in 2014 were 16 per cent in Singapore, 7.6 per cent in Taiwan, 6.7 per cent in Hong Kong, 4.4 per cent in Malaysia, 1.6 per cent in India, 0.7 per cent in Indonesia, and 0.3 per cent in the Philippines. In India, for example, Xiaomi only sold three million phones in a year, compared to India's yearly total smartphone sales of 80100 million. Xiaomi's market share was very small, behind Samsung's 23 per cent and Micromax's 17 per cent. Moreover, more and more Chinese smartphone brands were entering the Indian market, putting tremendous pressure on Xiaomi Jun Lei's Concerns Lei's disappointment was obvious when he finished his speech at the annual meeting. His dream was becoming more and more difficult to pursue. Lei reached out to co-founder Wanqiang Li asking him to retum to Xiaomi. In 2011, Li had been responsible for the formation of Xiaomi's web, operations, marketing, service, business, logistics, and other businesses. But in October 2014. Li had suddenly announced his resignation; he wanted to build new products in Silicon Valley for a period of time. Li suggested to Lei two strategies: (1) Seek offline partners and establish an international strategic alliance. Offline partners could provide more channels to Xiaomi and the partners could share the risk of expanding into overseas markets. (2) Develop MIUI and its peripheral smart hardware, allowing Xiaomi to pursue a new market share and reduce patent disputes. 90 Which strategy should Lei choose, or was there a better way? EXHIBIT 1: FINANCING OF BEIJING XIAOMI TECHNOLOGY CO. LTD. Date Investors Investment Valuation June 2011 $41 million $250 million December 2011 $90 million $1,000 million June 2012 Xiaomi Group, Morningside Ventures, Qiming Venture Partners, IDG Morningside Ventures, Shun Fund, IDG. Morning Capital. Qualcomm Ventures. Temasek Holdings DST and others (unknown due to confidentiality agreement) DST All-Stars Investment, DST Global, GIC. Hopu Investment, Yunfeng Fund $216 million $4.000 million August 2013 Unknown $10.000 million December 2014 $1,100 million $45.000 million Note: Currency amounts are in U.S. dollars. Source: "Millet Official Confirms the Completion of a New Round of $1.1 Billion Financing for a Valuation of S45 Billion" 38Kr. December 29, 2014, accessed January 17, 2017, http://36kr.com/p/218240.html [in Chinese]. EXHIBIT 2: SENIOR MANAGEMENT OF BEIJING XIAOMI TECHNOLOGY CO.LTD. Founding Team Business Distribution Jun Lei Founder, chairman, and chief executive officer Bin Lin Wangiang Li Guangping Zhou Kong-Kat Wong Feng Hong Co-founder and president Co-founder and senior vice-president, MIUI and Mi.com (resigned 2014) Co-founder and senior vice-president, hardware and firmware Co-founder and vice-president, Mi WiFi and Mi Cloud Co-founder and vice-president, MIUI Co-founder and vice-president, Mi TV and Mi Box Co-founders and vice-president, industrial design and ecosystem development Chuan Wang De Liu Senior Managers Shou Zi Chew Xiang Wang Hugo Barra Chief financial officer Senior vice-president, supply chain and intellectual property Vice-president, global division Vice-president, content investment and operation Ecological chain product development and Xiaomi explore lab Tong Chen Mu Tang Jain Manu Xiaomi India Donovan Sung International product development EXHIBIT 3: SMARTPHONE VENDORS, SHIPMENTS, AND MARKET SHARE, 2015 (IN US$ MILLIONS) Global Shipment Market Share Domestic Shipment Market Share Overseas Shipment Ratio of Overseas Shipment to Global Shipment 41.0% Huawei 106.80 7.4% 62.90 14.5% 43.70 Xiaomi 70.80 4.9% 64.90 15.0% 5.90 8.3%