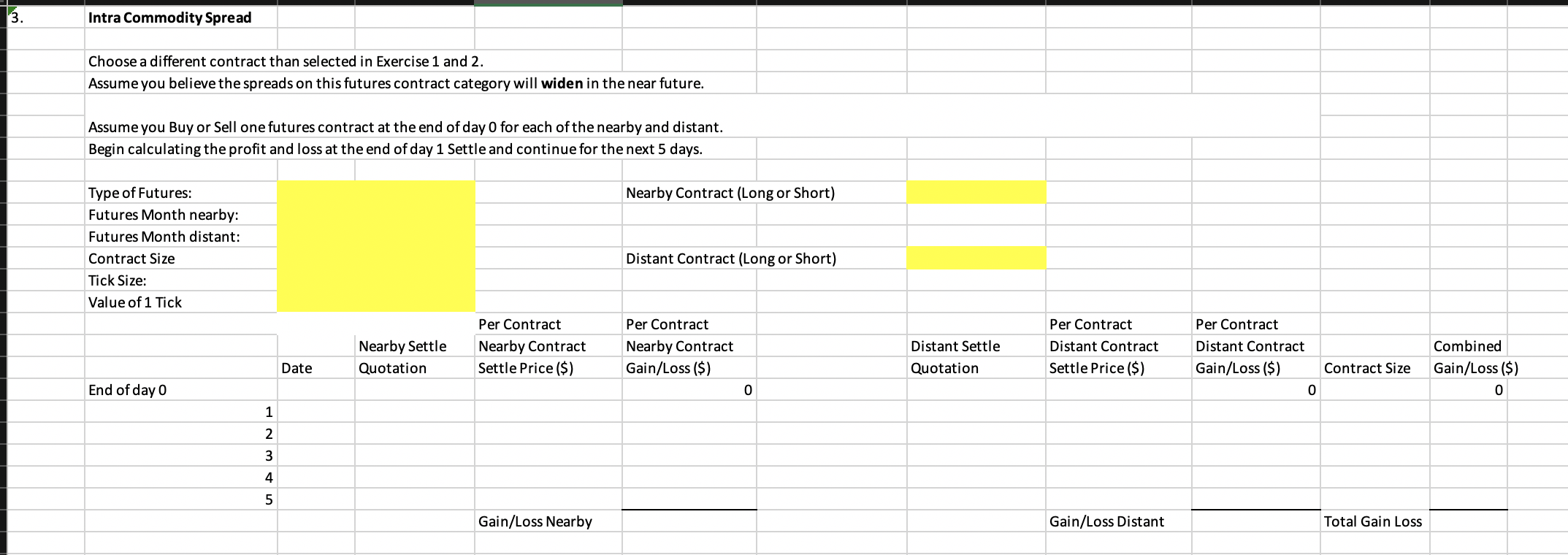

Question: 3. Intra Commodity Spread Choose a different contract than selected in Exercise 1 and 2. Assume you believe the spreads on this futures contract category

3. Intra Commodity Spread Choose a different contract than selected in Exercise 1 and 2. Assume you believe the spreads on this futures contract category will widen in the near future. Assume you Buy or Sell one futures contract at the end of day 0 for each of the nearby and distant. Begin calculating the profit and loss at the end of day 1 Settle and continue for the next 5 days. Nearby Contract (Long or Short) Type of Futures: Futures Month nearby: Futures Month distant: Contract Size Tick Size: Value of 1 Tick Distant Contract (Long or Short) Nearby Settle Quotation Per Contract Nearby Contract Settle Price ($) Per Contract Nearby Contract Gain/Loss ($) Distant Settle Quotation Per Contract Distant Contract Settle Price ($) Per Contract Distant Contract Gain/Loss ($) 0 Date Contract Size Combined Gain/Loss ($) 0 End of day o 0 1 2 3 mt 4 5 Gain/Loss Nearby Gain/Loss Distant Total Gain Loss 3. Intra Commodity Spread Choose a different contract than selected in Exercise 1 and 2. Assume you believe the spreads on this futures contract category will widen in the near future. Assume you Buy or Sell one futures contract at the end of day 0 for each of the nearby and distant. Begin calculating the profit and loss at the end of day 1 Settle and continue for the next 5 days. Nearby Contract (Long or Short) Type of Futures: Futures Month nearby: Futures Month distant: Contract Size Tick Size: Value of 1 Tick Distant Contract (Long or Short) Nearby Settle Quotation Per Contract Nearby Contract Settle Price ($) Per Contract Nearby Contract Gain/Loss ($) Distant Settle Quotation Per Contract Distant Contract Settle Price ($) Per Contract Distant Contract Gain/Loss ($) 0 Date Contract Size Combined Gain/Loss ($) 0 End of day o 0 1 2 3 mt 4 5 Gain/Loss Nearby Gain/Loss Distant Total Gain Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts