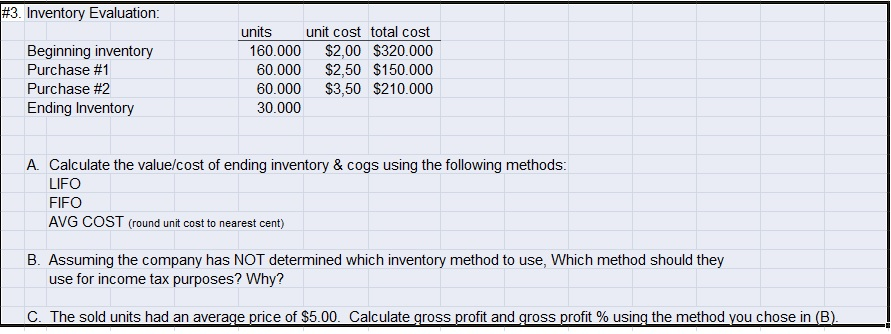

Question: #3. Inventory Evaluation: Beginning inventory Purchase #1 Purchase #2 Ending Inventory units unit cost total cost 160.000 $2,00 $320.000 60.000 $2,50 $150.000 60.000 $3,50 $210.000

#3. Inventory Evaluation: Beginning inventory Purchase #1 Purchase #2 Ending Inventory units unit cost total cost 160.000 $2,00 $320.000 60.000 $2,50 $150.000 60.000 $3,50 $210.000 30.000 A. Calculate the value/cost of ending inventory & cogs using the following methods: LIFO FIFO AVG COST (round unit cost to nearest cent) B. Assuming the company has NOT determined which inventory method to use, which method should they use for income tax purposes? Why? C. The sold units had an average price of $5.00. Calculate gross profit and gross profit % using the method you chose in (B)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts