Question: 3. Johnson Inc. is considering a new project that has a life of 3 years. The initial capital (fixed assets) investment for the project is

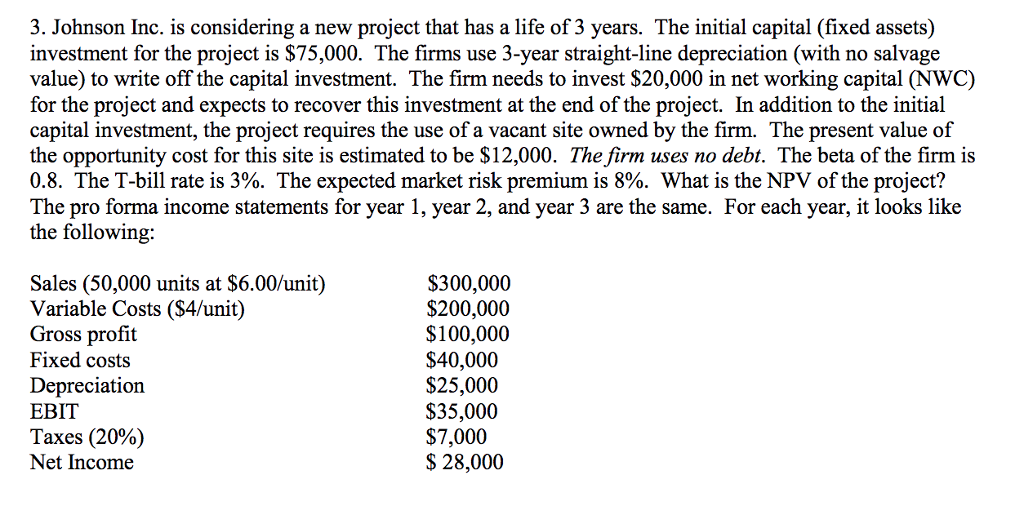

3. Johnson Inc. is considering a new project that has a life of 3 years. The initial capital (fixed assets) investment for the project is $75,000. The firms use 3-year straight-line depreciation (with no salvage value) to write off the capital investment. The firm needs to invest $20,000 in net working capital (NWC) for the project and expects to recover this investment at the end of the project. In addition to the initial capital investment, the project requires the use of a vacant site owned by the firm. The present value of the opportunity cost for this site is estimated to be $12,000. The firm uses no debt. The beta of the firm is 0.8. The T-bill rate is 3%. The expected market risk premium is 8%. What is the NPV of the project? The pro forma income statements for year 1, year 2, and year 3 are the same. For each year, it looks like the following: Sales (50,000 units at $6.00/unit) Variable Costs (S4/unit) Gross profit Fixed costs Depreciation EBIT Taxes (20%) Net Income $300,000 $200,000 $100,000 $40,000 $25,000 $35,000 $7,000 $ 28,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts