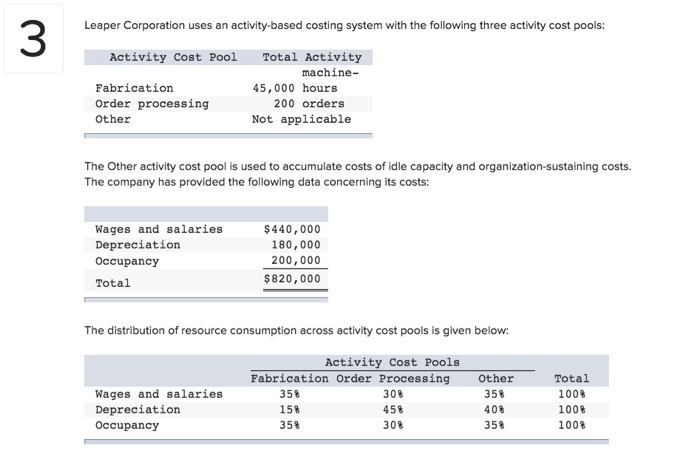

Question: 3 Leaper Corporation uses an activity-based costing system with the following three activity cost pools: Total Activity machine- Activity Cost Pool Fabrication 45,000 hours 200

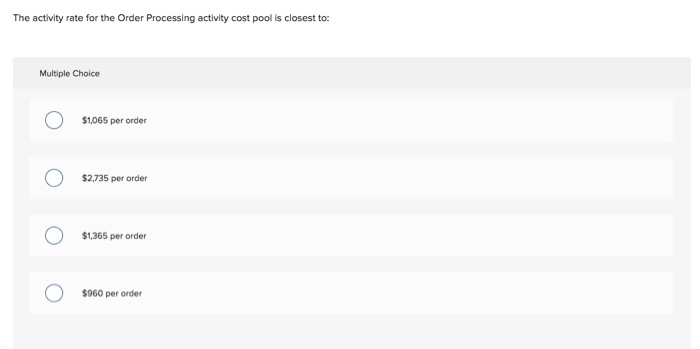

3 Leaper Corporation uses an activity-based costing system with the following three activity cost pools: Total Activity machine- Activity Cost Pool Fabrication 45,000 hours 200 orders Order processing other Not applicable The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs: Wages and salarie Depreciation Occupancy Total $440,000 180,000 200,000 $820,000 The distribution of resource consumption across activity cost pools is given below Activity Cost Pools Other 35% 40% 35% Fabrication Order Processing Wages and salaries Depreciation Occupancy 358 158 358 30% 458 30% Total 100% 1008 1008

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts