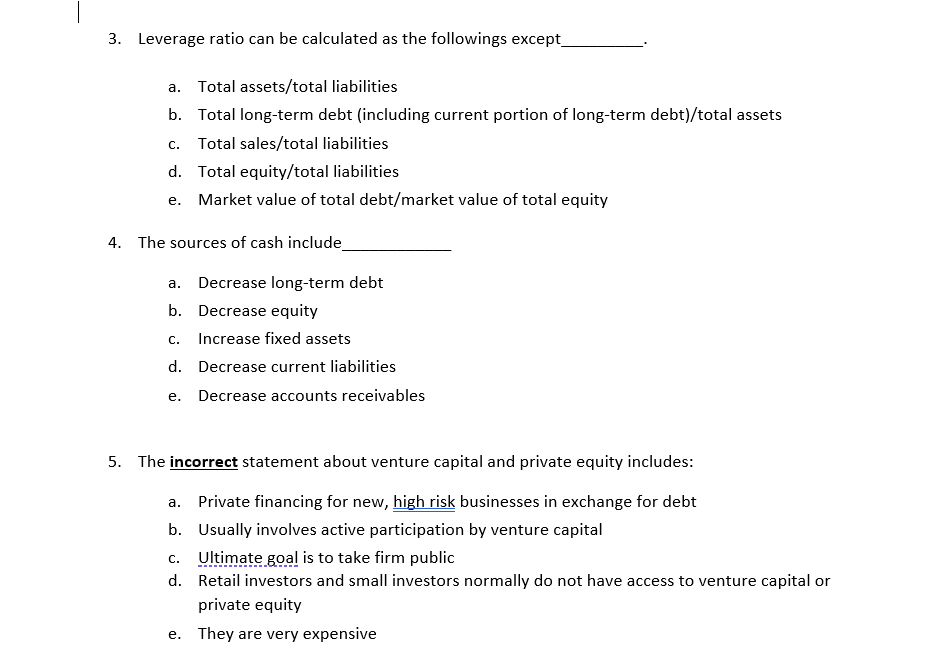

Question: 3. Leverage ratio can be calculated as the followings except a. Total assets/total liabilities b. Total long-term debt (including current portion of long-term debt)/total assets

3. Leverage ratio can be calculated as the followings except a. Total assets/total liabilities b. Total long-term debt (including current portion of long-term debt)/total assets Total sales/total liabilities d. Total equity/total liabilities e. Market value of total debt/market value of total equity C. 4. The sources of cash include a. C. Decrease long-term debt b. Decrease equity Increase fixed assets d. Decrease current liabilities Decrease accounts receivables e. 5. The incorrect statement about venture capital and private equity includes: a. Private financing for new, high risk businesses in exchange for debt b. Usually involves active participation by venture capital C. Ultimate goal is to take firm public d. Retail investors and small investors normally do not have access to venture capital or private equity e. They are very expensive 3. Leverage ratio can be calculated as the followings except a. Total assets/total liabilities b. Total long-term debt (including current portion of long-term debt)/total assets Total sales/total liabilities d. Total equity/total liabilities e. Market value of total debt/market value of total equity C. 4. The sources of cash include a. C. Decrease long-term debt b. Decrease equity Increase fixed assets d. Decrease current liabilities Decrease accounts receivables e. 5. The incorrect statement about venture capital and private equity includes: a. Private financing for new, high risk businesses in exchange for debt b. Usually involves active participation by venture capital C. Ultimate goal is to take firm public d. Retail investors and small investors normally do not have access to venture capital or private equity e. They are very expensive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts