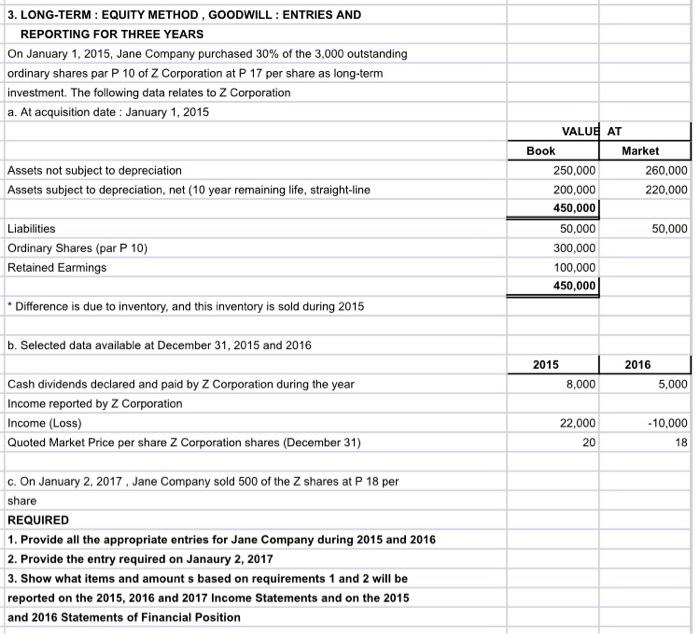

Question: 3. LONG-TERM : EQUITY METHOD, GOODWILL : ENTRIES AND REPORTING FOR THREE YEARS On January 1, 2015, Jane Company purchased 30% of the 3,000 outstanding

3. LONG-TERM : EQUITY METHOD, GOODWILL : ENTRIES AND REPORTING FOR THREE YEARS On January 1, 2015, Jane Company purchased 30% of the 3,000 outstanding ordinary shares par P 10 of Z Corporation at P 17 per share as long-term investment. The following data relates to Z Corporation a. At acquisition date: January 1, 2015 Assets not subject to depreciation Assets subject to depreciation, net (10 year remaining life, straight-line VALUE AT Book Market 250,000 260,000 200,000 220,000 450,000 50,000 50,000 300,000 100,000 450,000 Liabilities Ordinary Shares (par P 10) Retained Earmings Difference is due to inventory, and this inventory is sold during 2015 b. Selected data available at December 31, 2015 and 2016 2015 2016 8,000 5,000 Cash dividends declared and paid by Z Corporation during the year Income reported by Z Corporation Income (Loss) Quoted Market Price per share Z Corporation shares (December 31) 22,000 20 -10,000 18 c. On January 2, 2017 Jane Company sold 500 of the 2 shares at P 18 per share REQUIRED 1. Provide all the appropriate entries for Jane Company during 2015 and 2016 2. Provide the entry required on Janaury 2, 2017 3. Show what items and amounts based on requirements 1 and 2 will be reported on the 2015, 2016 and 2017 Income Statements and on the 2015 and 2016 Statements of Financial Position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts