Question: (3 marks) Part B (Lesson 7) 1. Indicate whether each of the following statements is true or false and explain your answer. (a) For a

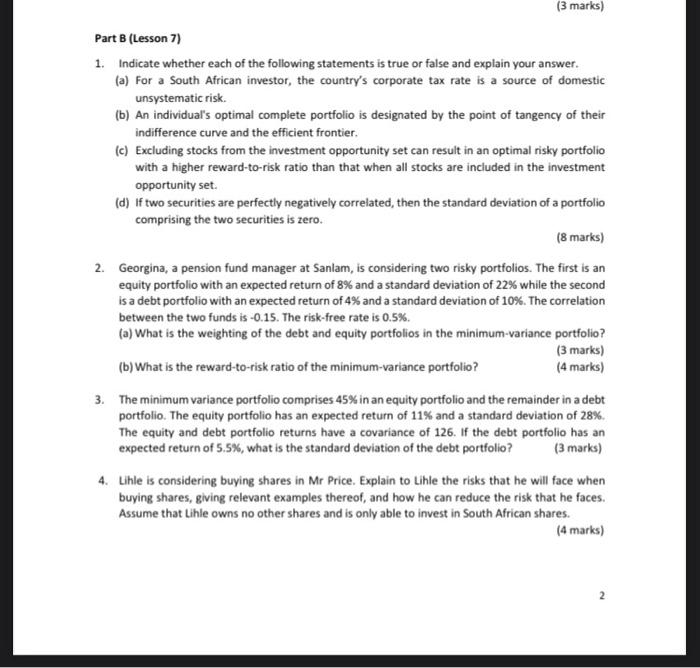

(3 marks) Part B (Lesson 7) 1. Indicate whether each of the following statements is true or false and explain your answer. (a) For a South African investor, the country's corporate tax rate is a source of domestic unsystematic risk. (b) An individual's optimal complete portfolio is designated by the point of tangency of their indifference curve and the efficient frontier. (c) Excluding stocks from the investment opportunity set can result in an optimal risky portfolio with a higher reward-to-risk ratio than that when all stocks are included in the investment opportunity set (d) If two securities are perfectly negatively correlated, then the standard deviation of a portfolio comprising the two securities is zero. (8 marks) 2. Georgina, a pension fund manager at Sanlam, is considering two risky portfolios. The first is an equity portfolio with an expected return of 8% and a standard deviation of 22% while the second is a debt portfolio with an expected return of 4% and a standard deviation of 10%. The correlation between the two funds is -0.15. The risk-free rate is 0.5%. (a) What is the weighting of the debt and equity portfolios in the minimum-variance portfolio? (3 marks) (b) What is the reward-to-risk ratio of the minimum-variance portfolio? (4 marks) 3. The minimum variance portfolio comprises 45% in an equity portfolio and the remainder in a debt portfolio. The equity portfolio has an expected return of 11% and a standard deviation of 28%. The equity and debt portfolio returns have a covariance of 126. If the debt portfolio has an expected return of 5.5%, what is the standard deviation of the debt portfolio? (3 marks) 4. Lihle is considering buying shares in Mr Price. Explain to Lihle the risks that he will face when buying shares, giving relevant examples thereof, and how he can reduce the risk that he faces. Assume that Lihle owns no other shares and is only able to invest in South African shares. (4 marks) 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts