Question: 3) Modified Duration is more effective in measuring interest rate risk for bonds that... a) have embedded options (callable bonds and mortgage securities). b) Ho

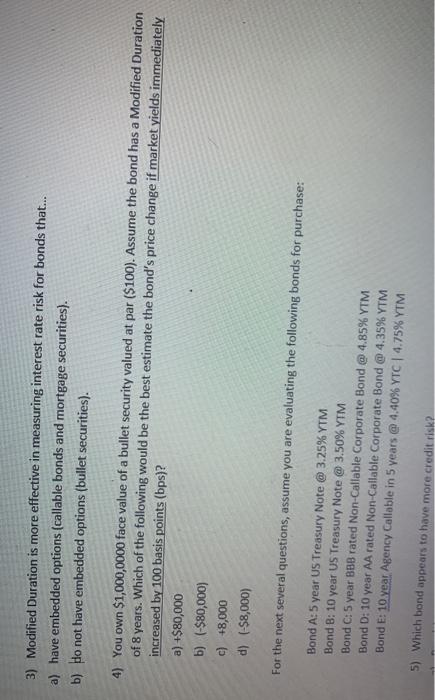

3) Modified Duration is more effective in measuring interest rate risk for bonds that... a) have embedded options (callable bonds and mortgage securities). b) Ho not have embedded options (bullet securities). 4) You own $1,000,0000 face value of a bullet security valued at par ($100). Assume the bond has a Modified Duration of 8 years. Which of the following would be the best estimate the bond's price change if market yields immediately increased by 100 basis points (bps)? a) $80,000 b) (-$80,000) c) +8,000 d) (-$8,000) For the next several questions, assume you are evaluating the following bonds for purchase: Bond A: 5 year US Treasury Note @3.25% YTM Bond B: 10 year US Treasury Note @3.50% YTM Bond C: 5 year BBB rated Non-Callable Corporate Bond @ 4.85% YTM Bond D: 10 year AA rated Non-Callable Corporate Bond @ 4.35% YTM Bond E: 10 year Agency Callable in 5 years @ 4,40% YTC 4.75% YTM 5) Which bond appears to have more credit risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts