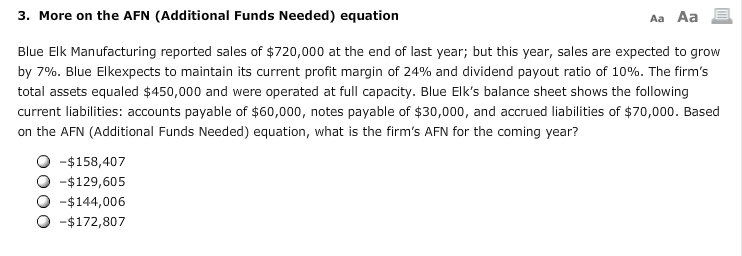

Question: 3. More on the AFN (Additional Funds Needed) equation Aa Aa Blue Elk Manufacturing reported sales of $720,000 at the end of last year; but

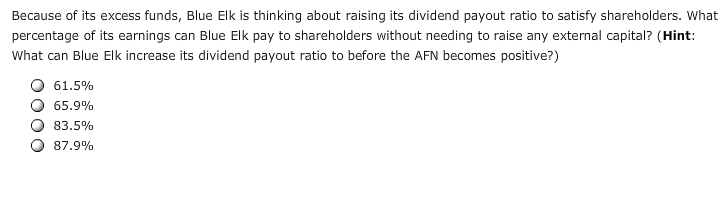

3. More on the AFN (Additional Funds Needed) equation Aa Aa Blue Elk Manufacturing reported sales of $720,000 at the end of last year; but this year, sales are expected to grow by 7%. Blue Elkexpects to maintain its current profit margin of 24% and dividend payout ratio of 10%. The firm's total assets equaled $450,000 and were operated at full capacity. Blue Elk's balance sheet shows the following current liabilities: accounts payable of $60,000, notes payable of $30,000, and accrued liabilities of $70,000. Based on the AFN (Additional Funds Needed) equation, what is the firm's AFN for the coming year? O -$158,407 O -$129,605 O-$144,006 O-$172,807 Because of its excess funds, Blue Elk is thinking about raising its dividend payout ratio to satisfy shareholders. What percentage of its earnings can Blue Elk pay to shareholders without needing to raise any external capital? (Hint: What can Blue Elk increase its dividend payout ratio to before the AFN becomes positive?) o 61.5% o 65.9% O 83.5% O 87.990

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts