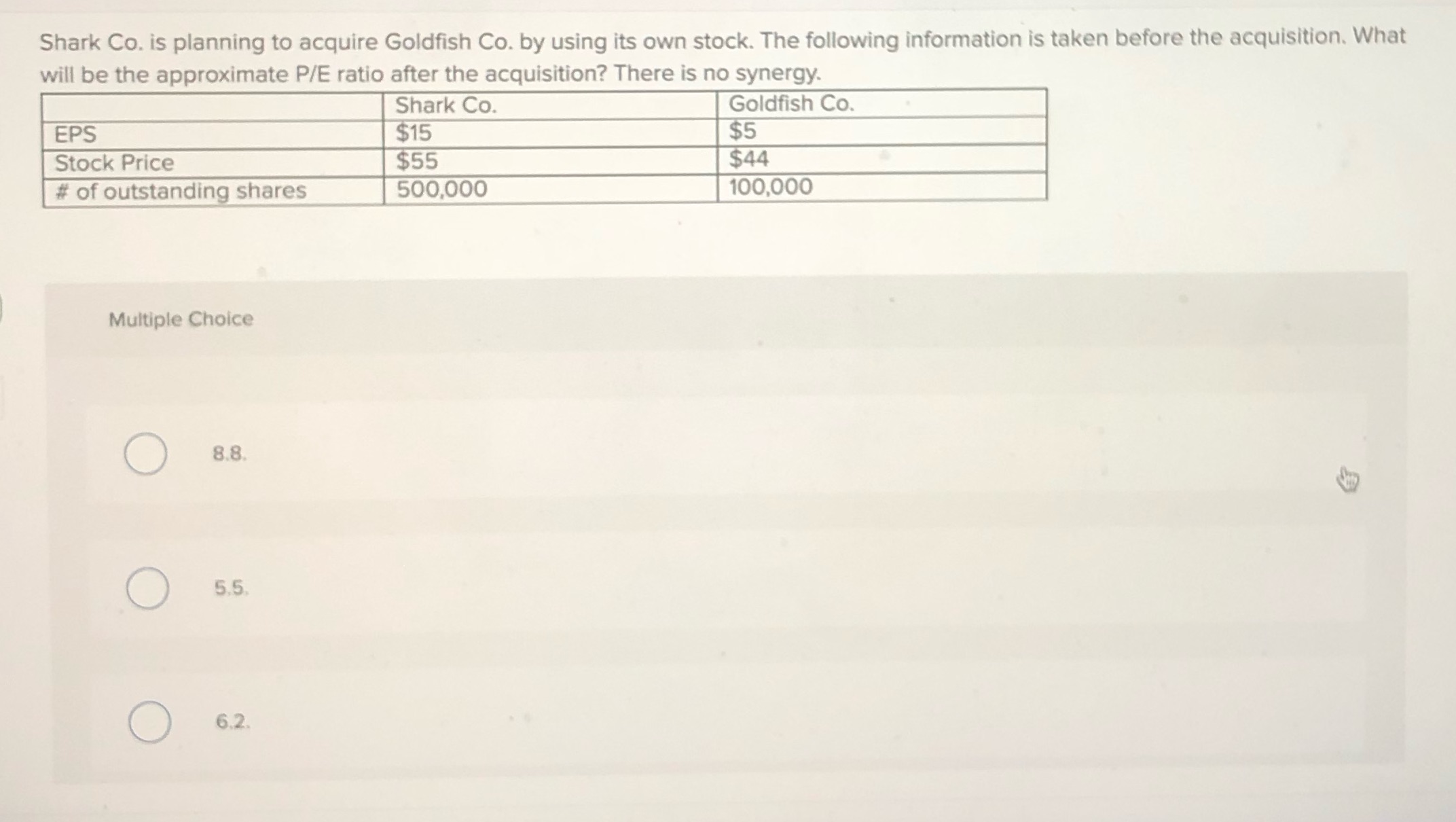

Question: 3. Multiple choice. Answers are cut off so here they are provided. A. 8.8B. 5.5 C. 6.2 D. 3.7E. 4.0 Shark Co. is planning to

3. Multiple choice. Answers are cut off so here they are provided. A. 8.8B. 5.5 C. 6.2 D. 3.7E. 4.0

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock