Question: 3. Net present value method Consider the case of Rydell Enterprises: Rydell Enterprises is evaluating a proposed capital budgeting project that will require an initial

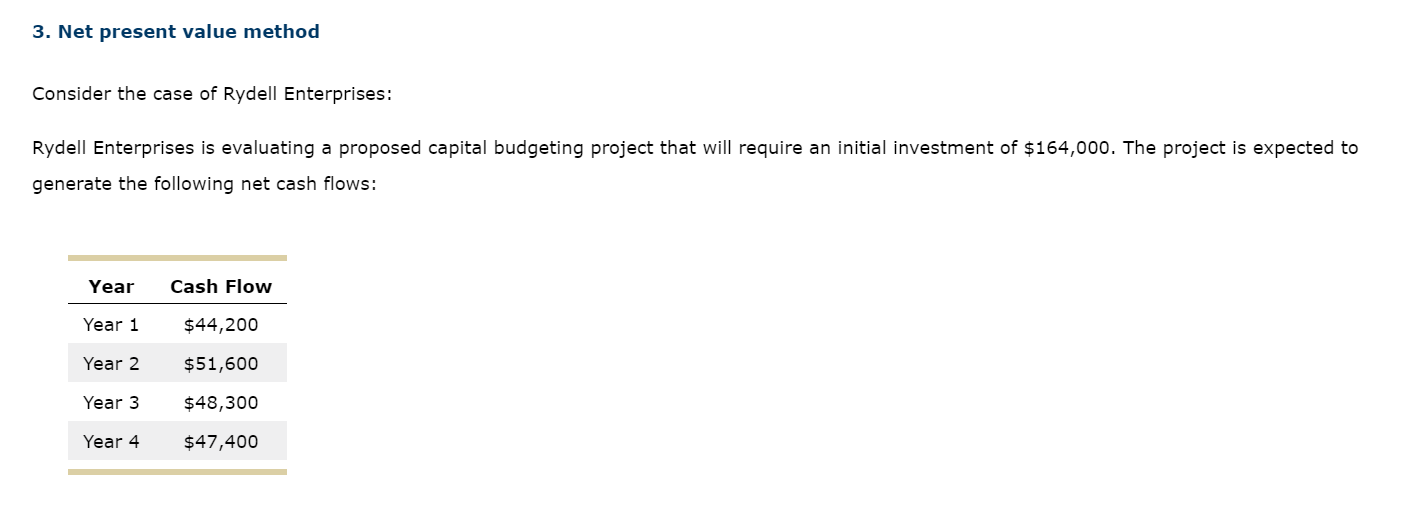

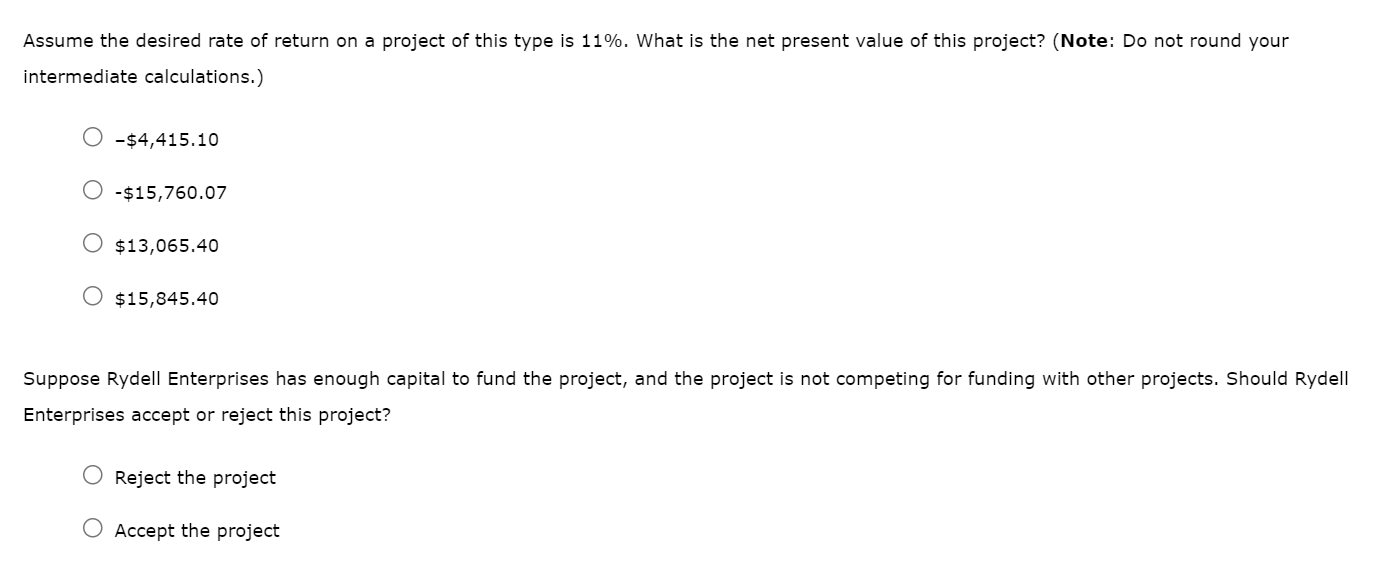

3. Net present value method Consider the case of Rydell Enterprises: Rydell Enterprises is evaluating a proposed capital budgeting project that will require an initial investment of $164,000. The project is expected to generate the following net cash flows: Assume the desired rate of return on a project of this type is 11%. What is the net present value of this project? (Note: Do not round your intermediate calculations.) $4,415.10 $15,760.07 $13,065.40 $15,845.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts