Question: 3) Now consider something that might happen one year from today, that is halfway through your two-year plan. Suppose that at that time the overnight

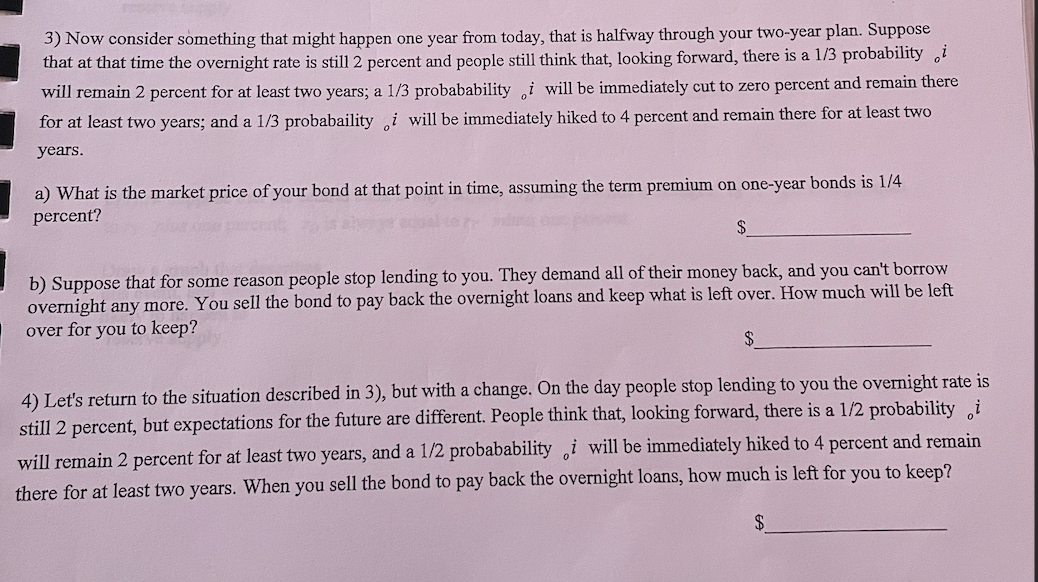

3) Now consider something that might happen one year from today, that is halfway through your two-year plan. Suppose that at that time the overnight rate is still 2 percent and people still think that, looking forward, there is a 1/3 probability i will remain 2 percent for at least two years; a 1/3 probabability i will be immediately cut to zero percent and remain there for at least two years; and a 1/3 probabaility i will be immediately hiked to 4 percent and remain there for at least two years. a) What is the market price of your bond at that point in time, assuming the term premium on one-year bonds is 1/4 percent? $ b) Suppose that for some reason people stop lending to you. They demand all of their money back, and you can't borrow overnight any more. You sell the bond to pay back the overnight loans and keep what is left over. How much will be left over for you to keep? 4) Let's return to the situation described in 3), but with a change. On the day people stop lending to you the overnight rate is still 2 percent, but expectations for the future are different. People think that, looking forward, there is a 1/2 probability i will remain 2 percent for at least two years, and a 1/2 probabability i will be immediately hiked to 4 percent and remain there for at least two years. When you sell the bond to pay back the overnight loans, how much is left for you to keep? $ 3) Now consider something that might happen one year from today, that is halfway through your two-year plan. Suppose that at that time the overnight rate is still 2 percent and people still think that, looking forward, there is a 1/3 probability i will remain 2 percent for at least two years; a 1/3 probabability i will be immediately cut to zero percent and remain there for at least two years; and a 1/3 probabaility i will be immediately hiked to 4 percent and remain there for at least two years. a) What is the market price of your bond at that point in time, assuming the term premium on one-year bonds is 1/4 percent? $ b) Suppose that for some reason people stop lending to you. They demand all of their money back, and you can't borrow overnight any more. You sell the bond to pay back the overnight loans and keep what is left over. How much will be left over for you to keep? 4) Let's return to the situation described in 3), but with a change. On the day people stop lending to you the overnight rate is still 2 percent, but expectations for the future are different. People think that, looking forward, there is a 1/2 probability i will remain 2 percent for at least two years, and a 1/2 probabability i will be immediately hiked to 4 percent and remain there for at least two years. When you sell the bond to pay back the overnight loans, how much is left for you to keep? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts