Question: 3. only solve 3. Directions: Select the BEST answer for eoch question and mark it on the Scantron Use this information to answer the next

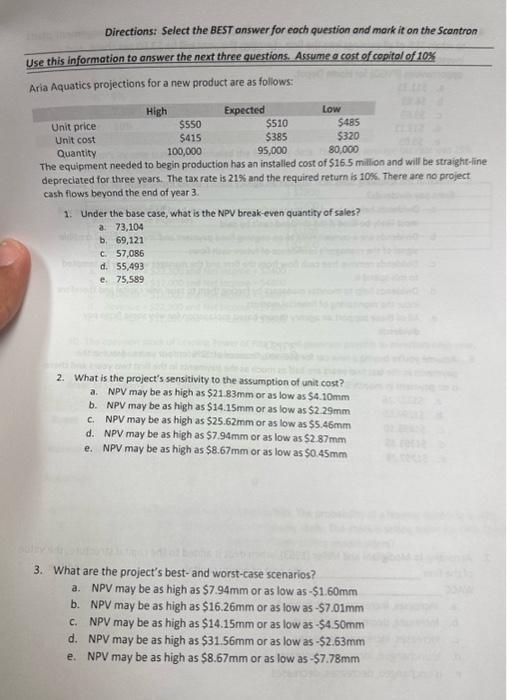

Directions: Select the BEST answer for eoch question and mark it on the Scantron Use this information to answer the next three questions. Assume a cost of copitol of 10\% Aria Aquatics projections for a new product are as follows: The equipment needed to begin production has an installed cost of 516.5 minton and will be straight-line depreciated for three years. The tax rate is 21% and the required return is 105 . There are no project cash flows beyond the end of year 3. 1. Under the base case, what is the NPV break-even quantity of sales? a. 73,104 b. 69,121 c. 57,086 d. 55,493 e. 75,589 2. What is the project's sensitivity to the assumption of unit cost? a. NPV may be as high as $21.83mm or as low as $4.10mm b. NPV may be as high as $14.15mm or as low as $2.29mm c. NPV may be as high as $25.62mm or as low as $5.46mm d. NPV may be as high as $7.94mm or as low as $2.87mm e. NPV may be as high as $8.67mm or as low as $0.45mm 3. What are the project's best-and worst-case scenarios? a. NPV may be as high as $7.94mm or as low as $1.60mm b. NPV may be as high as $16.26mm or as low as $7.01mm c. NPV may be as high as $14.15mm or as low as $4.50mm d. NPV may be as high as $31.56mm or as low as $2.63mm e. NPV may be as high as $8.67mm or as low as $7.78mm Directions: Select the BEST answer for eoch question and mark it on the Scantron Use this information to answer the next three questions. Assume a cost of copitol of 10\% Aria Aquatics projections for a new product are as follows: The equipment needed to begin production has an installed cost of 516.5 minton and will be straight-line depreciated for three years. The tax rate is 21% and the required return is 105 . There are no project cash flows beyond the end of year 3. 1. Under the base case, what is the NPV break-even quantity of sales? a. 73,104 b. 69,121 c. 57,086 d. 55,493 e. 75,589 2. What is the project's sensitivity to the assumption of unit cost? a. NPV may be as high as $21.83mm or as low as $4.10mm b. NPV may be as high as $14.15mm or as low as $2.29mm c. NPV may be as high as $25.62mm or as low as $5.46mm d. NPV may be as high as $7.94mm or as low as $2.87mm e. NPV may be as high as $8.67mm or as low as $0.45mm 3. What are the project's best-and worst-case scenarios? a. NPV may be as high as $7.94mm or as low as $1.60mm b. NPV may be as high as $16.26mm or as low as $7.01mm c. NPV may be as high as $14.15mm or as low as $4.50mm d. NPV may be as high as $31.56mm or as low as $2.63mm e. NPV may be as high as $8.67mm or as low as $7.78mm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts