Question: 3 P Do Homework - Chapter 16 Pearson Text BFIN 142-41 M Homework: Chapter 16 Question 4, Exercise 16- 12 (similar to) Part 1 of

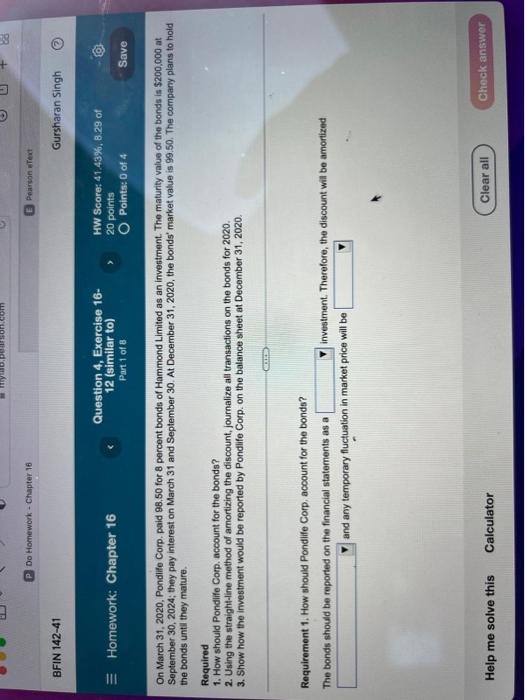

3 P Do Homework - Chapter 16 Pearson Text BFIN 142-41 M Homework: Chapter 16 Question 4, Exercise 16- 12 (similar to) Part 1 of 8 HW Score: 41.43%, 8.29 of 20 points O Points: 0 of 4 Save On March 31, 2020, Pondlife Corp. paid 98.50 for 8 percent bonds of Hammond Limited as an investment. The maturity value of the bonds is $200,000 at September 30, 2024; they pay interest on March 31 and September 30. At December 31, 2020, the bonds' market value is 99.50. The company plans to hold the bonds until they mature. Required 1. How should Pondlife Corp. account for the bonds? 2. Using the straight-line method of amortizing the discount, journalize all transactions on the bonds for 2020. 3. Show how the investment would be reported by Pondlife Corp. on the balance sheet at December 31, 2020. Requirement 1. How should Pondlife Corp, account for the bonds? The bonds should be reported on the financial statements as a investment. Therefore, the discount will be amortized Help me solve this Clear all and any temporary fluctuation in market price will be Calculator 88 Gursharan Singh Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts