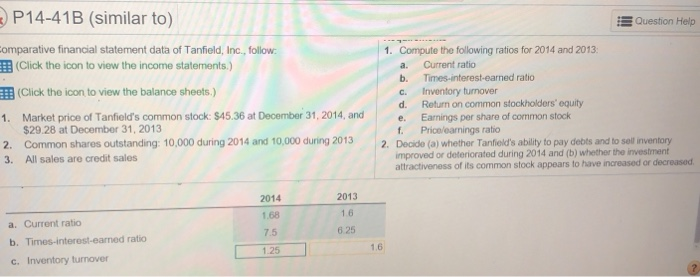

Question: 3 P14-41B (similar to) Question Help Comparative financial statement data of Tanfield, Inc., follow (Click the icon to view the income statements.) !! (Click the

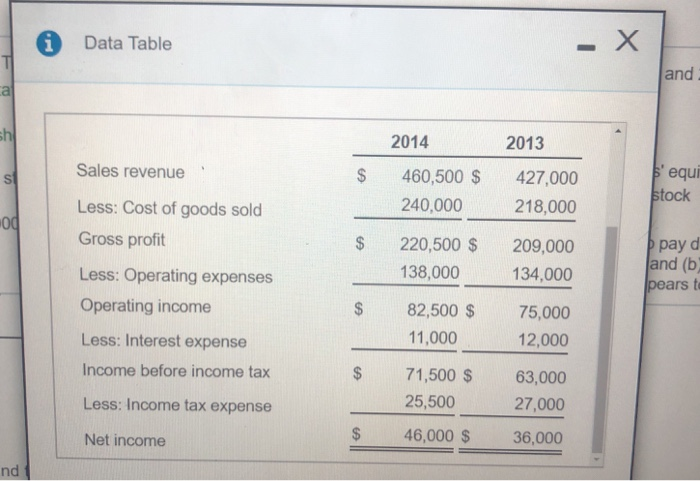

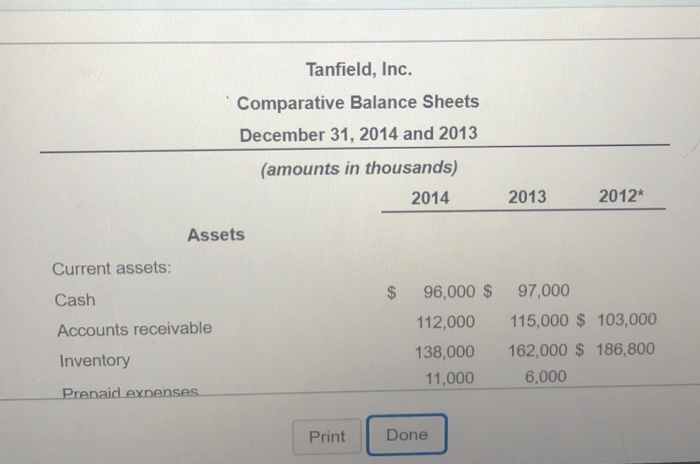

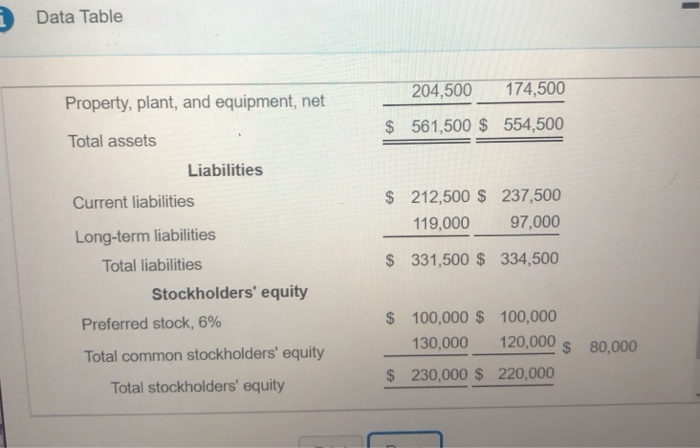

3 P14-41B (similar to) Question Help Comparative financial statement data of Tanfield, Inc., follow (Click the icon to view the income statements.) !! (Click the icon to view the balance sheets.) 1. Compute the following ratios for 2014 and 2013: a. Current ratio b. Times-interest-earned ratio C. Inventory turnover d. Return on common stockholders' equity e. Earnings per share of common stock f. Price/earnings ratio 2. Decide (a) whether Tanfield's ability to pay debts and to sell inventory improved or deteriorated during 2014 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased 1. Market price of Tanfield's common stock: $45.36 at December 31, 2014, and $29.28 at December 31, 2013 2. Common shares outstanding: 10,000 during 2014 and 10,000 during 2013 3. All sales are credit sales 2014 1.68 2013 1.6 6.25 a. Current ratio b. Times-interest-earned ratio C. Inventory turnover i Data Table - X and COF 2014 2013 Sales revenue Less: Cost of goods sold Gross profit s'equi stock 460,500 $ 240,000 220,500 $ 138,000 82,500 $ 11,000 427,000 218,000 209,000 134,000 75,000 12,000 pay d and (b) pears to Less: Operating expenses Operating income Less: Interest expense Income before income tax 71,500 $ 25,500 63,000 27,000 Less: Income tax expense Net income 46,000 $ 36,000 nd Data Table Property, plant, and equipment, net 204,500 174,500 $ 561,500 $ 554,500 Total assets Liabilities $ 212,500 $ 237,500 119,000 97,000 $ 331,500 $ 334,500 Current liabilities Long-term liabilities Total liabilities Stockholders' equity Preferred stock, 6% Total common stockholders' equity Total stockholders' equity $ 100,000 $ 100,000 130,000 120,000 $ 80,000 230,000 $ 220,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts