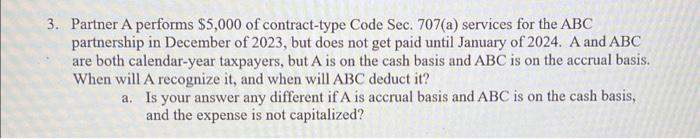

Question: 3. Partner A performs $5,000 of contract-type Code Sec. 707(a) services for the ABC partnership in December of 2023, but does not get paid until

3. Partner A performs $5,000 of contract-type Code Sec. 707(a) services for the ABC partnership in December of 2023, but does not get paid until January of 2024. A and ABC are both calendar-year taxpayers, but A is on the cash basis and ABC is on the accrual basis. When will A recognize it, and when will ABC deduct it? a. Is your answer any different if A is accrual basis and ABC is on the cash basis, and the expense is not capitalized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts