Question: 3 parts to this question, please answer all correct for thumps up! A rich relative has bequeathed you a growing perpetuity. The first payment will

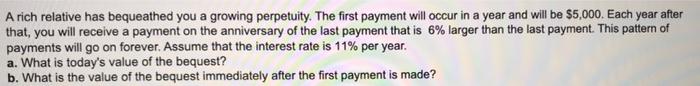

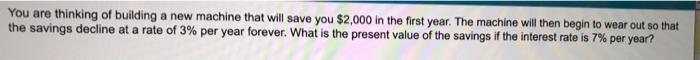

A rich relative has bequeathed you a growing perpetuity. The first payment will occur in a year and will be $5,000. Each year after that, you will receive a payment on the anniversary of the last payment that is 6% larger than the last payment. This pattern of payments will go on forever. Assume that the interest rate is 11% per year. a. What is today's value of the bequest? b. What is the value of the bequest immediately after the first payment is made? You are thinking of building a new machine that will save you $2,000 in the first year. The machine will then begin to wear out so that the savings decline at a rate of 3% per year forever. What is the present value of the savings if the interest rate is 7% per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts