Question: 3. Please also share how you solved it Case 3 company's weighted average cost of capital, 2.25 points) A company has 600 000 shares of

3. Please also share how you solved it

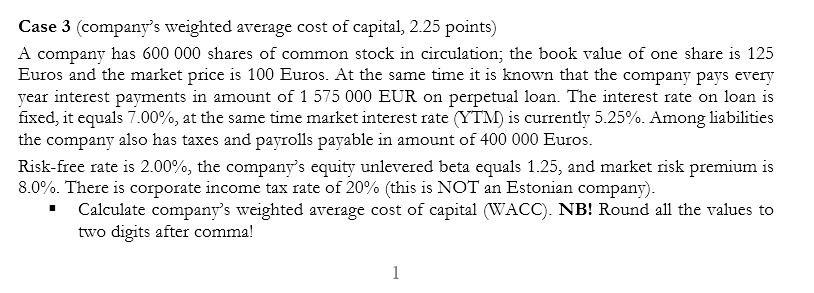

Case 3 company's weighted average cost of capital, 2.25 points) A company has 600 000 shares of common stock in circulation; the book value of one share is 125 Euros and the market price is 100 Euros. At the same time it is known that the company pays every year interest payments in amount of 1575 000 EUR on perpetual loan. The interest rate on loan is fixed, it equals 7.00%, at the same time market interest rate (YTM) is currently 5.25%. Among liabilities the company also has taxes and payrolls payable in amount of 400 000 Euros. Risk-free rate is 2.00%, the company's equity unlevered beta equals 1.25, and market risk premium is 8.0%. There is corporate income tax rate of 20% (this is NOT an Estonian company). Calculate company's weighted average cost of capital (WACC). NB! Round all the values to two digits after comma! 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts