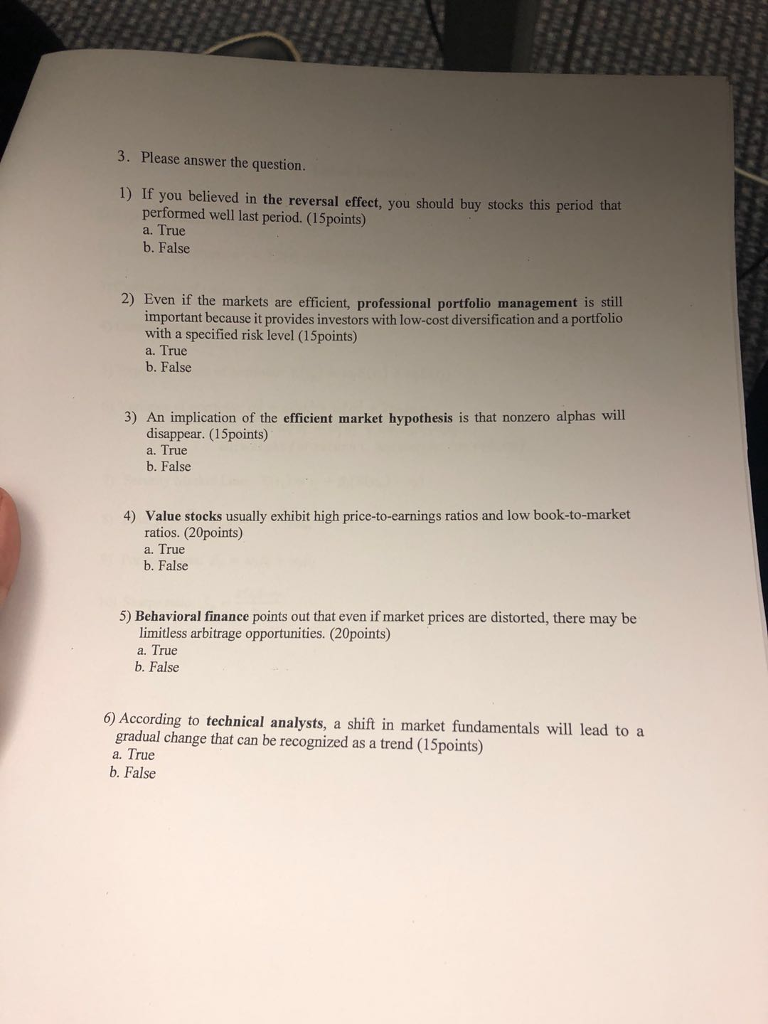

Question: 3. Please answer the question. 1) If you believed in the reversal effect, you should buy stocks this period that performed well last period. (15points)

3. Please answer the question. 1) If you believed in the reversal effect, you should buy stocks this period that performed well last period. (15points) a. True b. False 2) Even if the markets are efficient, professional portfolio management is still important because it provides investors with low-cost diversification and a portfolio with a specified risk level (15points) a. True b. False 3) An implication of the efficient market hypothesis is that nonzero alphas will disappear. (15points) a. True b. False 4) Value stocks usually exhibit high price-to-earnings ratios and low book-to-market ratios. (20points) a. True b. False 5) Behavioral finance points out that even if market prices are distorted, there may be limitless arbitrage opportunities. (20points) a. True b. False 6) According to technical analysts, a shift in market fundamentals will lead to a gradual change that can be recognized as a trend (15points) a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts