Question: 3. Please answer the question. 1) The complete portfolio refers to the investment in the risky portfolio and the index. (10points) a. True False 2)

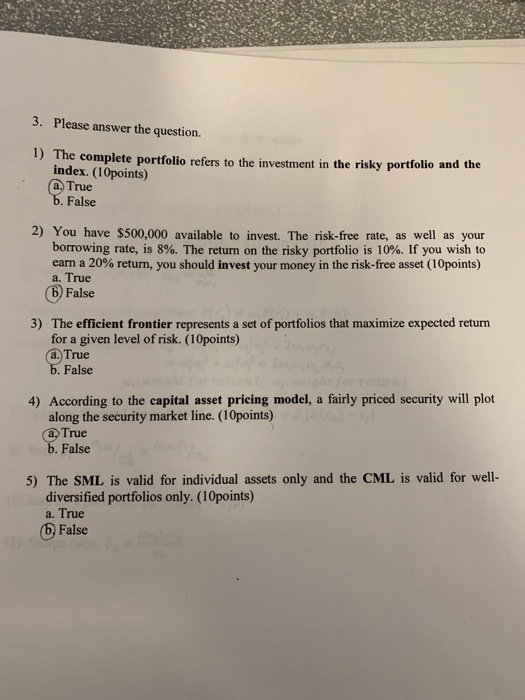

3. Please answer the question. 1) The complete portfolio refers to the investment in the risky portfolio and the index. (10points) a. True False 2) You have $500,000 available to invest. The risk-free rate, as well as your borrowing rate, is 8%. The return on the risky portfolio is 10%. If you wish to earn a 20% return, you should invest your money in the risk-free asset (10points) a. True False 3) The efficient frontier represents a set of portfolios that maximize expected return for a given level of risk. (10points) a. True False 4) According to the capital asset pricing model, a fairly priced security will plot along the security market line. (10points) True False 5) The SML is valid for individual assets only and the CML is valid for well- diversified portfolios only. (10points) a. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts