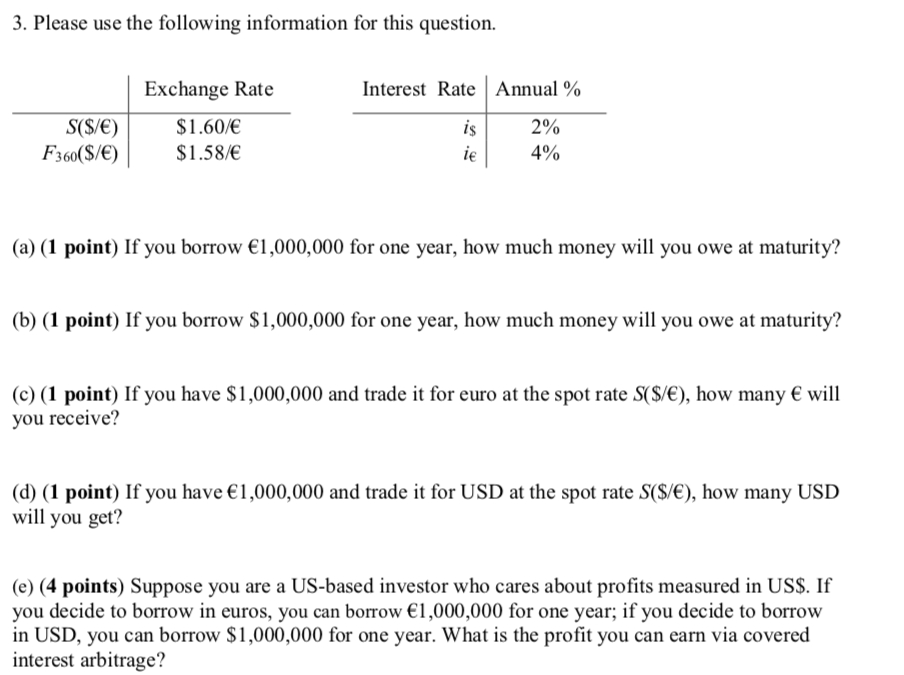

Question: 3. Please use the following information for this question. S($/) F360($/) Exchange Rate $1.60/ $1.58/ Interest Rate is i Annual % 2% 4% (a)

3. Please use the following information for this question. S($/) F360($/) Exchange Rate $1.60/ $1.58/ Interest Rate is i Annual % 2% 4% (a) (1 point) If you borrow 1,000,000 for one year, how much money will you owe at maturity? (b) (1 point) If you borrow $1,000,000 for one year, how much money will you owe at maturity? (c) (1 point) If you have $1,000,000 and trade it for euro at the spot rate S($/), how many will you receive? (d) (1 point) If you have 1,000,000 and trade it for USD at the spot rate S($/), how many USD will you get? (e) (4 points) Suppose you are a US-based investor who cares about profits measured in US$. If you decide to borrow in euros, you can borrow 1,000,000 for one year; if you decide to borrow in USD, you can borrow $1,000,000 for one year. What is the profit you can earn via covered interest arbitrage?

Step by Step Solution

There are 3 Steps involved in it

a If you borrow 1000000 for one year the amount of money you will owe at maturity can be calculated as follows Amount owed Principal Interest Interest ... View full answer

Get step-by-step solutions from verified subject matter experts