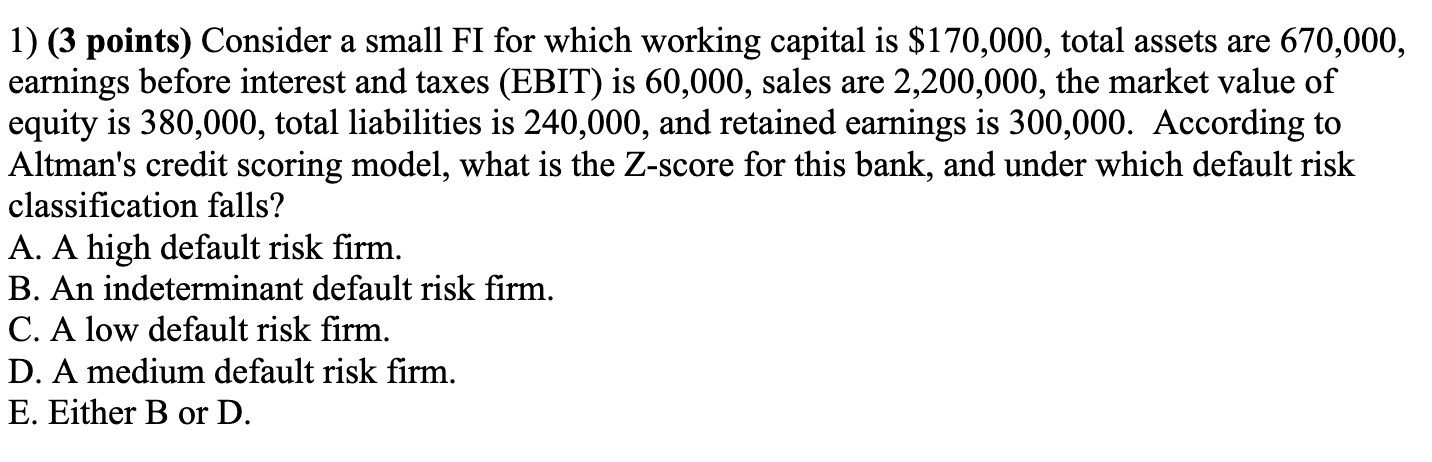

Question: ( 3 points ) Consider a small FI for which working capital is $ 1 7 0 , 0 0 0 , total assets are

points Consider a small FI for which working capital is $ total assets are

earnings before interest and taxes EBIT is sales are the market value of

equity is total liabilities is and retained earnings is According to

Altman's credit scoring model, what is the Zscore for this bank, and under which default risk

classification falls?

A A high default risk firm.

B An indeterminant default risk firm.

C A low default risk firm.

D A medium default risk firm.

E Either B or D

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock