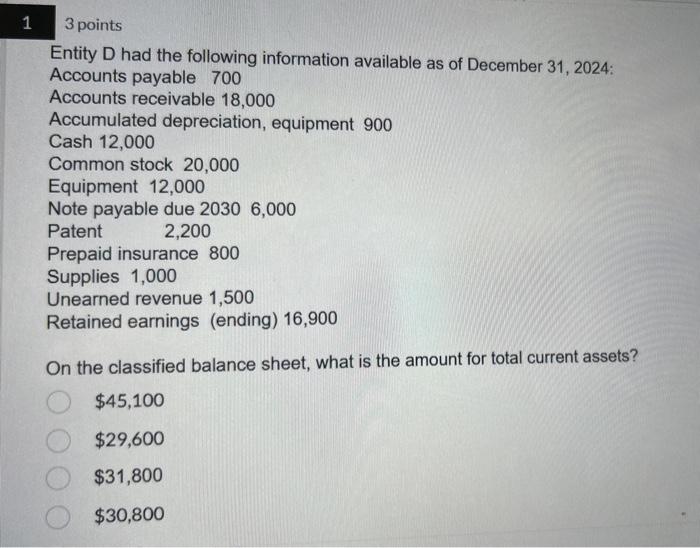

Question: 3 points Entity D had the following information available as of December 31, 2024: Accounts payable 700 Accounts receivable 18,000 Accumulated depreciation, equipment 900 Cash

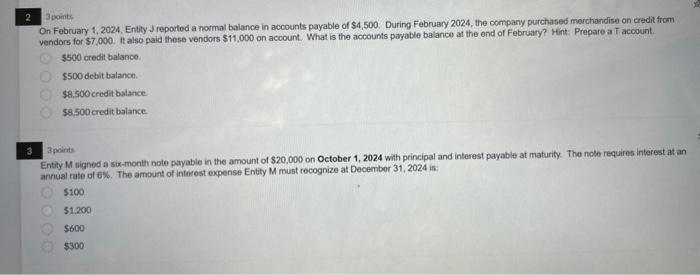

3 points Entity D had the following information available as of December 31, 2024: Accounts payable 700 Accounts receivable 18,000 Accumulated depreciation, equipment 900 Cash 12,000 Common stock 20,000 Equipment 12,000 Note payable due 20306,000 Patent 2,200 Prepaid insurance 800 Supplies 1,000 Unearned revenue 1,500 Retained earnings (ending) 16,900 On the classified balance sheet, what is the amount for total current assets? $45,100 $29,600 $31,800 $30,800 3 points On February 1,2024 , Entity J reported a normal balance in accounts payable of $4,500. During February 2024 , the company purchased merchandise on credit from vendors for $7,000. It also paid these vendors $11,000 on account. What is the accounts payable balance at the end of February? Hint: Prepare a T account. $500 credit balance. $500 debit balance. $8,500 credit balance. $8,500 credit balance. 3 poinits Enthy M signed a six-month note payable in the amount of $20,000 on October 1,2024 with principal and interest payable at maturity. The note requires interest at an annual rate of 6%. The amount of interest expense Entity M must recognize at December 31, 2024 is: $100 $1,200 $600 $300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts