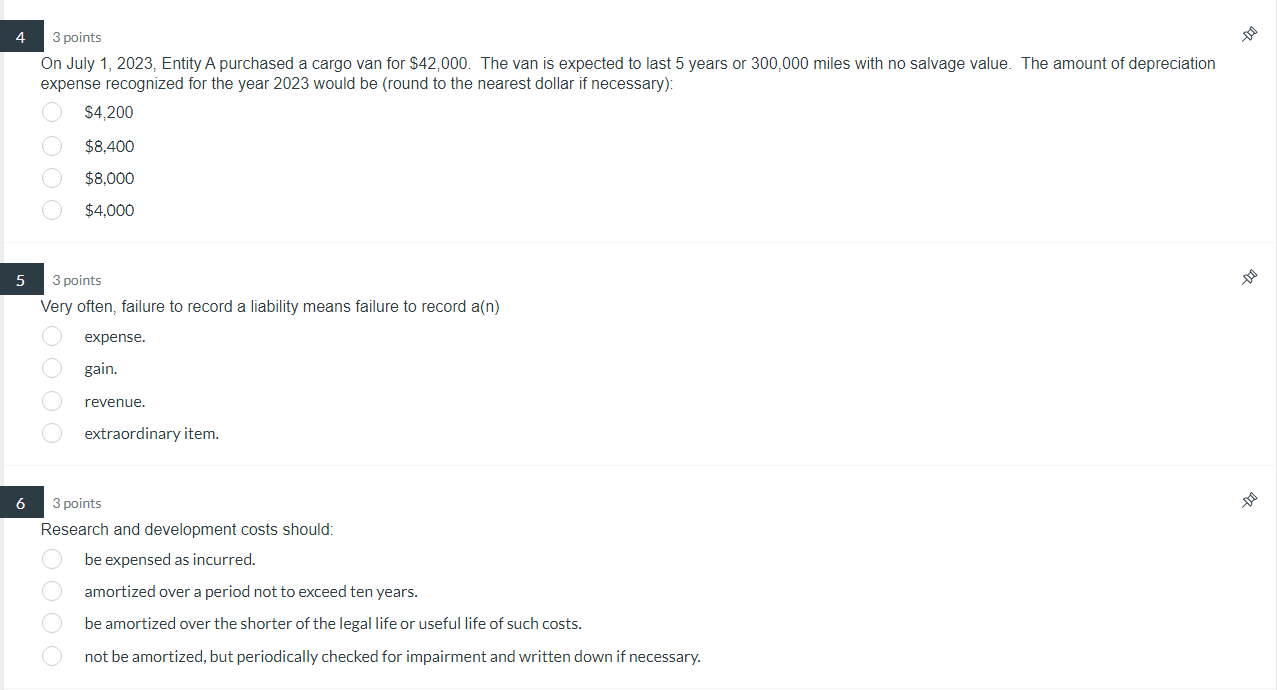

Question: 3 points On July 1,2023 , Entity A purchased a cargo van for $42,000. The van is expected to last 5 years or 300,000 miles

3 points On July 1,2023 , Entity A purchased a cargo van for $42,000. The van is expected to last 5 years or 300,000 miles with no salvage value. The amount of depreciation expense recognized for the year 2023 would be (round to the nearest dollar if necessary): $4,200$8,400$8,000$4,000 3 points Very often, failure to record a liability means failure to record a(n) expense. gain. revenue. extraordinary item. 3 points Research and development costs should: be expensed as incurred. amortized over a period not to exceed ten years. be amortized over the shorter of the legal life or useful life of such costs. not be amortized, but periodically checked for impairment and written down if necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts